Finding the best German health insurance can be very simple and at the same time very complex.

In fact, I still remember very clearly the day I took out my health insurance.

Although that was more than ten years ago. At that time, I went with my wife to the insurance office of a local public health insurance company.

The office was one of three possible insurance offices in our city. To be honest, I can’t even remember why we chose this one of all.

It could have been any other by chance.

With this article, I would like to introduce you to the subject of health insurance in Germany.

Besides my own experience, I would like to share more about a friend’s experience with other types of health insurance.

So, before you consider a new statutory or private health in Germany, let me tell you more about the most important things to keep in mind during the following chapters.

You can take out a private health insurance in Germany at:

Ottonova*- with English support

Check24* – in German

Key takeaways

1) Health insurance in Germany is compulsory

2) In Germany you can choose between public health insurance or private health insurance

3) Most people have a public health insurance

4) In order to be eligible for private health insurance in Germany you have to make at least 64,350 euros per year

5) Supplementary private insurance is possible, on volutary basis

6) International students have the possibility to take out health insurance in Germany

7) The European Health Insurance Card is valid in Germany

How to use the health insurance calculator without speaking German >> READ HERE OUR FULL GUIDE >>

Topics covered in this article

Why choose public health insurance in Germany? >>

Why choose private health insurance in Germany? >>

Difference between public and private health insurance in Germany? >>

Switch from private to public health insurance in Germany? >>

Health insurance for employees >>

Health insurance for self-employed >>

Health insurance in Germany for non-employed >>

Health insurance for international students >>

Do you need travel insurance in Germany? >>

Is the European Health Insurance Card (EHIC) valid in Germany? >>

Compare offers with the health insurance Germany calculator >>

CLICK HERE to go to Health Insurance Calculator* >>

What I could choose from

Health insurance is mandatory for all people living in Germany. In 2020, about 73.36 million people had statutory health insurance.

Private health insurance companies have a combined total of approximately 8.73 million insured people.

Compared to other countries, Germany has a very diverse range of health insurers. There are currently (2021) 103 statutory health insurers in Germany.

Even though the number of statutory health insurers has decreased significantly from 1,812 in 1970, Germany has a vast number of offerings compared to other countries. The largest statutory health insurance fund at present is Techniker Krankenkasse.

Public health insurance in Germany

First of all, I would like to give you an explanation of the statutory health insurance funds. These health insurance companies have a long tradition in Germany.

They belong to the German social security system and have the following tasks:

Preservation of health

Insured persons can see a doctor at any time and pay only a 10 Euro fee per quarter. And this applies when you see a doctor, psychotherapist or emergency medical service.

If you have questions about your health, you can make an appointment with a doctor at any time.

Restoration of health

If you do fall ill, you have the option of seeing a doctor at any time as a member of a statutory health insurance fund. Regardless of whether it is a serious matter or a simple cold.

Doctors take care of every insured person.

Apart from the quarterly fees, no further personal contribution is necessary. Only prescription drugs cost extra (10% of the retail price, minimum five euros, and maximum ten euros).

Improvement of the state of health

Remember that after an acute illness, surgery or injury, health insurance companies also cover follow-up care to improve your health.

Private health insurance in Germany

Private health insurers perform the same tasks in Germany. However, the billing system is different.

Here, the insured person first pays the treatment costs himself.

They then submit the invoices to the health insurance companies. In this way, the insured person gets a percentage of the costs back.

At the first glance, this may sound unattractive to many insured persons. But often, private health insurances cover 100% of the costs and include better services such as chief physician treatments.

Nevertheless, private health insurance can mean lower insurance costs. But not everyone can have private health insurance.

How to use the health insurance calculator without speaking German >> READ HERE OUR FULL GUIDE >>

This includes freelancers, self-employed, civil servants, doctors, students, and employees with an annual gross income of 64,350 euros or more (2021).

Supplementary private insurance

The third form of health insurance is voluntary private insurance. It is an alternative to private health insurance. You can also insure yourself voluntarily in the statutory health insurance.

Certain persons can claim voluntary insurance:

- Students who have completed their studies

- Severely disabled persons

- Employees returning from abroad

- People working in Germany for the first time

- pension recipients

- Temporary soldiers who finished their service

Joining the statutory health insurance fund as a voluntarily insured person can also be worthwhile for the self-employed. Here you have to register within the first three months after starting your self-employment.

Can I live in Germany without health insurance?

Germany has had compulsory health insurance since 2009. In 2019, the Federal Statistical Office determined that approximately 61,000 people still do not have health insurance in Germany.

Because even if you don’t have insurance, you run up premium debts. Even without a visit to the doctor. You have to pay these in arrears when you join the health insurance scheme.

According to these statistics, there are particularly many men, the unemployed and the self-employed in this situation.

Is German healthcare free?

Apart from small statutory co-payments, every insured person in the statutory health insurance fund is entitled to free treatment. As one of the oldest health care systems in the world, the German insurance system is one of the best in the world.

The health insurance system financing works on the basis of solidarity. This means that all insured persons bear the costs of individual cases of illness. In most cases, the choice of health insurance is up to the individual.

Statutory health insurance does not only pay for treatment costs. Even continued payment of wages is covered at 70% for a more extended period after more than six weeks of illness.

Why did I choose public health insurance in Germany?

Back to that time over ten years ago. Was it pure coincidence that I chose statutory health insurance back then? No, even if the choice of health insurance was a pure coincidence at the time. For my wife and me, a few criteria were decisive at the time.

Even though my salary at the time would have been sufficient to take out private health insurance, the advantages were more important to us:

1. Free insurance for my wife, who had a low income at the time.

2. The benefits of statutory health insurance were sufficient for us then, as they are now.

3. My wife and I do not have to pay in advance when treatment is required.

What is public health insurance in Germany?

Statutory health insurance in Germany is the most common type of health insurance, covering over 89 million people in Germany, and it covers the primary care of all insured persons.

Apart from minimal co-payments for doctor’s visits (per quarter) in the case of consulting a doctor and a prescription fee, there are no costs.

Costs for visits to the doctor, treatment, hospitalization, and follow-up care are settled directly by the insurance company with the hospitals.

In the event of a prolonged course of illness – longer than six weeks – the health insurance fund pays 70% of the gross salary to the employee.

Usually, the employer is still liable for 100% during the first six weeks, unless you are in the probationary period.

How much does public health insurance in Germany cost (me)?

The statutory health insurance is based on the employee’s salary. The insurance company receives 14.6% of the gross salary. The employer pays 7.3% of this. Many statutory health insurance companies in Germany require an additional contribution on average of 1.3% currently.

There is a contribution assessment ceiling, but the health insurance contribution is capped.

For instance, if an employee earns more than 4,837.50 euros gross per month, his contribution doesn’t increase further.

Some comparative values for this:

- Employees – 3,000 euros gross – pay between 224.25 and 259.50 euros a month

- Self-employed – 3,000 Euro gross – pay between 430.50 and 501 Euro per month

- Students pay between 78,85 and 97,13 Euro per month

- Trainees pay between 63.54 and 69.28 euros a month

- Pensioners – 1,500 Euro pension – pay between 112.13 and 129.75 Euro a month

- Spouses and children up to the age of 25 are covered free of charge via family insurance

How did I get mine in Germany?

As I have already told you, my wife and I ended up with VIACTIV, our current health insurance company, by chance.

We found out about the general benefits of a statutory health insurance fund in advance on Check24*.

This is how we found out that VIACTIV is not the cheapest among health insurance companies. Nevertheless, it still offers many benefits in addition to the standard health insurance coverage.

What covers my public health insurance in Germany?

First and foremost, statutory health insurance covers basic medical care without further ado.

This is because in Germany this is regulated in the Fifth Social Code “SGB V”. The Federal Joint Committee (G-BA) sets the precise guidelines here.

Secondly, statutory health insurance does not only cover preventive examinations and the free choice of doctor. In fact, the insurance company only approves the doctor and thus bills him or her with a health insurance company. The same applies to psychotherapists and dentists.

Let’s say, for example, that you need to go to a hospital for a specific reason. In this case, all standard services and approved therapies are covered.

However, other optional services such as treatment by a head physician or accommodation in a single bed are not included.

Can I take out additional insurance for special treatments?

However, additional insurance can be taken out for these particular treatments. I already talked about the case of incapacity to work due to illness for more than six weeks. Here, the health insurance companies cover 70% of the gross salary.

Mothers also have maternity benefits. Six weeks before and up to eight weeks after the birth, the health insurance fund also pays part of the money here. The employer pays the remaining difference.

In addition to psychotherapy, it also includes benefits for visual aids, free family insurance, and coverage for household help. Insurers often differ only in the additional voluntary benefits they cover.

Which is the best public health insurance in Germany?

In principle, all statutory health insurance funds provide the same essential services. However, it is crucial to take a closer look at the additional benefits and contributions.

How to use the health insurance calculator without speaking German >> READ HERE OUR FULL GUIDE >>

Depending on your personal needs, you should pay attention to critical additional benefits. These include:

- Professional dental cleaning

- Discounted dentures

- Homeopathic treatments

- Osteopathy

- Artificial inseminations

- Child and youth examinations

- Vaccinations outside the standard vaccinations

- Free choice of hospital

- Health courses

- Bonus programs

- Optional tariffs with premium refunds or deductibles

In an insurance comparison at Check24 / TarifCheck24* you will find the appropriate additional benefits.

Can I choose a doctor if I have public health insurance?

As a rule, you have free choice of doctor with all statutory health insurance plans. Not all health insurance companies also offer a free selection of hospitals. Here you should pay attention to the additional benefits.

Why did my friend Marius choose private health insurance in Germany?

Besides my own story, I would also like to tell you the story of my friend Marius. He came to Germany around the same time, and we both started working for the same company. He was also in a salary bracket where he could freely choose insurance.

At that time, he had chosen private health insurance because he was alone and did not have a partner. The special incentive was also that he was reimbursed for premiums when he was not at the doctor.

Private insurances sound better at first than public health insurances. Especially at that time, I noticed the advantages of private insurance in a conversation with him.

What is private health insurance in Germany?

Private health insurance in Germany is often associated with better rates and better benefits. For example, entry-level rates are sometimes cheaper. In addition, patients receive additional benefits and shorter waiting periods.

Private health insurance is primarily for civil servants, freelancers, or employees who earn over 64,350 euros gross per year. These insurance companies work independently of the statutory insurance companies and can determine their rates.

How to use the health insurance calculator without speaking German >> READ HERE OUR FULL GUIDE >>

How much does private health insurance in Germany cost?

The insurance premium for private health insurance depends on income, profession, age, the selected benefits, state of health, pre-existing conditions, and the desired deductible.

For a 35-year-old, the rates can vary between 326 euros and 592 euros. Civil servants are the only ones who have the advantage of a state subsidy for health insurance.

How did my friend Marius get health insurance in Germany?

Finding private health insurance is similarly straightforward. There are often independent insurance brokers who advise independently of insurance providers.

However, the best way to find private health insurance today is to compare it on Check24:

Private health insurance Germany calculator*

What covers private health insurance in Germany?

When considering what private health insurance in Germany covers, it is essential to check the offers carefully. Your advantage is: If you have a good contract, the benefits can not be reduced afterward.

The main difference between private and public health insurance is that private insurers pay 100% of medications. Private insurers also pay up to 90% for dental treatment.

Particularly for the self-employed, the payment of a daily sickness allowance from the first day is essential.

Which is the best private health insurance in Germany?

Stiftung Warentest reviewed 32 insurance companies and 107 tariffs in 2019. In the process, the insurance of my friend Marius was concluded as the best insurance. Debeka is currently listed as the best private insurance. The independent testing company Franke Bornberg regularly conducts a comparison of insurers and tariffs.

What is the difference between public and private health insurance in Germany?

With private insurance, there is no family insurance, i.e., all family members must be insured individually. For single people, this can be advantageous. However, depending on the requirements, it can quickly become expensive for families.

Compensation for this is the non-use of medical or treatment services. If one does not use insurance services for six months, one will be reimbursed for the premiums, depending on the insurance company.

Age benefits are usually better with private health insurance, as is treatment by a chief physician.

How can I switch from private to public health insurance in Germany?

Switching from private health insurance back to statutory insurance in Germany is not that easy. Marius had recently dealt with the issue and told me that it wouldn’t be easy for him.

It it only possible under special conditions:

If the salary falls below 64,350 euros, one comes under the limit as an employee

Suppose you are self-employed and give up your self-employment as the primary source of income. Therefore you need to have a permanent employment relationship

If you have a partner in statutory health insurance, you can return to statutory health insurance. The key is free family insurance

When you don’t have a job, you have to go back to compulsory insurance anyway

In case you are temporarily living or working in another European country and come back to Germany after a while

You are 55 or older, the change becomes very difficult. The reason is that a career change rarely takes place after this age

How to use the health insurance calculator without speaking German >> READ HERE OUR FULL GUIDE >>

Statutory insurance companies often draw a line for re-enrollment at age 45.

Health insurance for employees in Germany

Statutory health insurance covers slightly more than 89% of all persons subject to compulsory insurance in Germany. In Germany, the settlement of the insurance contribution is directly linked to the payment of wages. As an immigrant, this can be a new experience. When starting a new job, employers ask some questions that are important for billing.

Employers cannot mandate health insurance in Germany. Each employee can make their own choice for their health insurance.

What my employer asked from me in the first days of work

My employer has asked me the following questions about my health insurance. These are important for payroll accounting. In Germany, the employer pays 50% of the health insurance contributions, including 50% of the additional contribution.

Employers need the following information from employees within the first few days:

- Membership certificate of the health insurance company

- In case of a disability: proof of severe disability

If you want to change the health insurance company, inform your employer in time.

Sick Pay Insurance in Germany

In Germany, there is additional sick pay insurance, “Krankentagegeldversicherung.” Daily sickness benefit insurance is recommended if you earn above the income threshold of 4,537.50 euros gross. Here, one should choose insurance depending on one’s own cost of living.

This insurance pays a daily agreed amount in case of illness. In this way, missing income can be compensated.

If you do not receive sick pay from statutory health insurance (privately insured or self-employed), you should take out insurance.

Daily sickness benefits are tax and duty free and are paid out net.

In this case, there is no need for daily hospital allowance insurance.

How to use the health insurance calculator without speaking German >> READ HERE OUR FULL GUIDE >>

Health insurance in Germany for self-employed

There are two different health insurance options for self-employed persons. The choice is between voluntary insurance with a statutory health insurance fund. Alternatively, you can insure yourself with a private insurance company.

For voluntary insurance in statutory health insurance, income is used to determine the contribution.

Private health insurance companies often offer more favorable rates for the self-employed. Here, one’s own income does not play a role. What is decisive is the age of the insured, the individual state of health, and the desired benefits.

Find out best as described below in the insurance comparison of Check24 about the appropriate services and costs:

German health insurance for non-employed

If you find yourself in the situation of being unemployed, the Federal Employment Agency will pay your health insurance contributions. This also applies to statutory long-term care insurance. Even if you do not receive unemployment benefits at the beginning of unemployment because of the blocking period.

If you are unemployed for an extended period and receive unemployment benefit II (Arbeitslosengeld II), the “Jobcenter” pays all contributions. In both cases, 100% of the insurance is covered.

If one was legally insured before unemployment, everything remains as usual. If you were previously covered by private health insurance, you must switch to statutory insurance.

There are exceptions here as well:

If you have been privately insured for more than five years, you can remain in private insurance.

If you are 55 years or older, you also remain privately insured. You do have the option to change to a cheaper tariff.

If you are younger than 55, you can apply for exemption from compulsory insurance. If the application is granted, you do not have to switch to statutory health insurance.

How to use the health insurance calculator without speaking German >> READ HERE OUR FULL GUIDE >>

German health insurance for international students

Health insurance is also available for international students who study in Germany. The DAAD, the German Academic Exchange Service, additionally informs that health insurance must be taken out before starting your studies.

Students from the EU can have their existing health insurance recognized by statutory health insurance. Usually, the insurance in the country of origin helps with this.

Even private health insurance is recognized in some cases. In this case, however, it is not possible to switch to statutory health insurance in Germany.

In both cases, students need a European Health Insurance Card (EHIC).

If the existing insurance is not recognized, the statutory health insurance companies must accept students from abroad. This applies to all students up to the age of 29 or up to the 14th semester.

Statutory health insurance costs around 110 euros per month for international students.

Do you need travel insurance in Germany?

Travel health insurance can be helpful if you have guests from abroad for a long time. Here there are various offers from insurance companies.

The insurance companies offer favorable health insurance rates from up to 6 months (PROVISIT VISUM) up to 5 years stay as a guest without work in Germany (HanseMerkur).

All guests must have valid health insurance in Germany to keep their residence status. For members of a Schengen member state living in Germany, this is also a good alternative.

Is the European Health Insurance Card (EHIC) valid in Germany?

Yes, the European Health Insurance Card (EHIC) is recognized in Germany.

If you unexpectedly fall ill in Germany as a foreigner, the EHIC is sufficient to be taken care of in case of an accident or an acute illness.

However, if you decide for specific reasons to be treated in Germany as a foreigner and therefore go to Germany, you should better talk to your health insurance beforehand. Often costs are not covered. Also chronically ill people should speak to their insurance ahead of the stay in Germany.

Find the best German health insurance with the private health insurance Germany calculator

As you have learned, there are many things to consider when choosing a health insurance plan. The easiest and fastest way to find the right private health insurance in Germany is to follow the next steps.

A good starting point is the website of Tarifcheck* (a company of Check24).

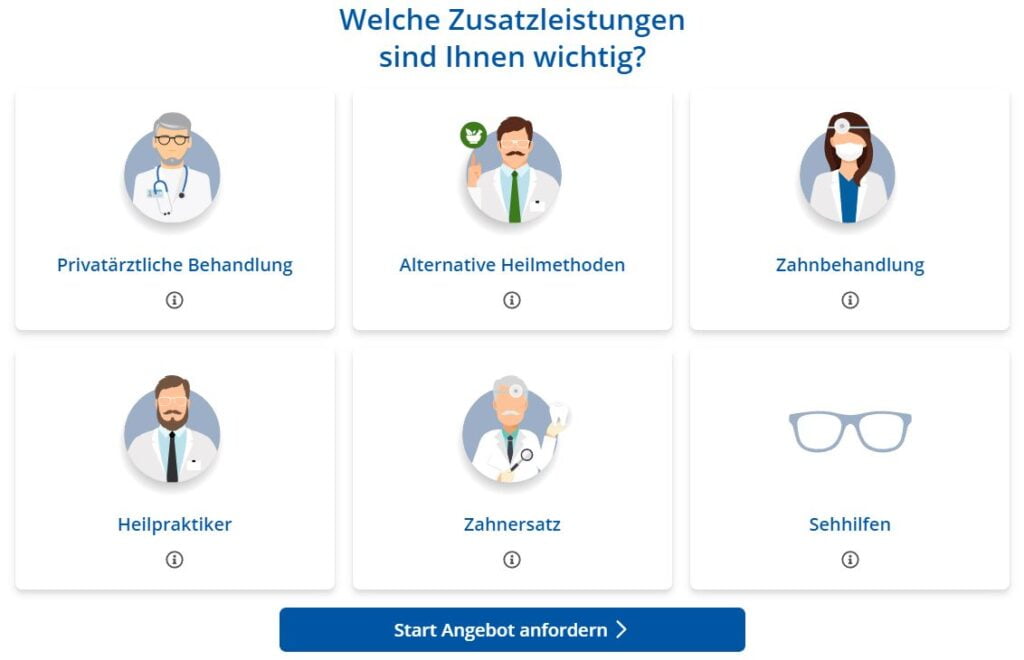

Step 1 – Choose the additional health services that are important to you

You can choose one or more additional services:

- Private medical treatment (Privatärztliche Behandlung)

- Alternative healing methods (Alternative Heilmethoden)

- Dental treatment (Zahnbehandlung)

- Alternative practitioners (Heilpraktiker)

- Dental prosthesis (Zahnersatz)

- Visual aids (Sehhilfen)

After choosing the services, click Start request offer (Start Angebot anfordern). You’ll then move to step two.

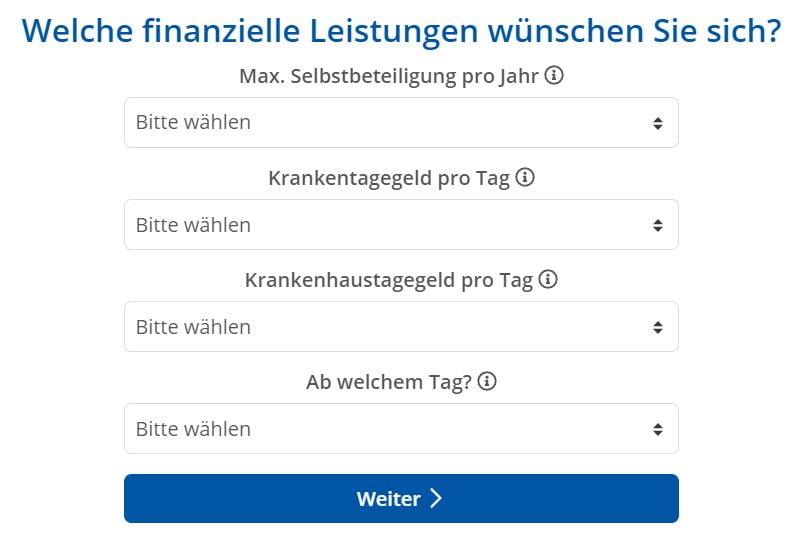

Step 2 – Choose your financial contributions for the private health insurance in Germany

The decisions you take here will influence your monthly or yearly contribution.

Maximum deductible per year (Max. Selbstbeteiligung pro Jahr)

According to Tarifcheck, the monthly insurance premium decreases if you contribute to the medical costs with a certain amount per year.

They also recommend that you do not set your deductible too high. This is because the employer pays half of your contribution, but not the deductible.

For example, here you can choose between 0 € to 2.000 € deductible per year.

Daily sickness benefit per day (Krankentagegeld pro Tag)

Tarifcheck says that in private health insurance, the daily sickness allowance is your financial protection in the event of absence from work because of a long illness. As legally required, the employer will continue paying wages, but not more than 42 days.

However, freelancers and self-employed persons don’t get this benefit. They have to pay from the first day.

Daily hospital allowance per day (Krankenhaustagegeld pro Tag)

The insurer pays a daily hospital allowance to the privately insured person for each day of hospitalization.

Privately insured persons do not usually incur any additional costs in the hospital. Thus, the daily hospital allowance is not mandatory for private health insurance in Germany.

According to Tarifcheck, waiving the daily hospital allowance leads to a reduction in the premium.

From which day? (Ab welchem Tag?)

Tarifcheck recommends the following:

- From the 43rd day, if you are employed

- If you are freelancer, from the first day

- Even so, if you have the option of drawing on savings, they recommend choosing a later date. From the third week, this means from the 22nd day. This will reduce your premium.

After you make your choices, click on continue (Weiter).

Step 3 – Do you want to be treated by the chief physician?

In this step you have to choose between two options:

- Chefarztbehandlung (treated by the chief physician)

- Keine Chefarztbehandlung (No treatment by chief physician)

Make your choice and click on continue (Weiter) to go to the next step.

Step 4 – Do you prefer a 1-bed room?

In this case, you have the possibility to choose between 1-bed or 2-bed room.

Worthless to mention, that the 1-bed room option is more expensive.

The same as above, click on Weiter (continue) to go to step 5, after you made your choice.

Step 5 – Personal information for the private health insurance Germany calculator

At this point, Tarifcheck needs a few personal details from you.

Familienstand – Marital status

Depending on your situation, you can choose between:

- ledig – single

- verheiratet – married

- geschieden – divorced

Anzahl Kinder – How many children do you have?

The number of kids has also an important influence on how high your premium for the private health insurance in Germany will be.

Berufsstand – Profession

Choose depending upon your situation:

- Arbeiter/in – worker

- Beamtin / Beamter – civil officer

- Angestellte/r – employee

- Selbstständige/r – self-employed

- Freiberufler/in – freelancer

- Student/in – student

Mindestverdienst p.a. von 64.350 € – Annual gross salary of at least 64.350 €

As written above, if you are an employee, you need to have at least 64.350 € to be allowed to have private health insurance in Germany.

You can choose your answer here: Ja (yes) or Nein (no).

Now click on Weiter (continue).

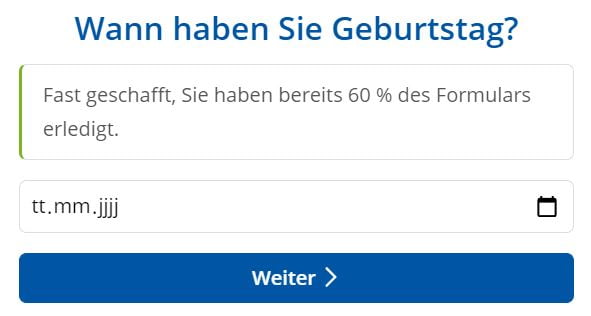

Step 6 – Date of birth

Insert your date of birth

- TT (Tag) – DD (Day)

- MM (Monat) – MM (month)

- JJJJ (Jahr) – YYYY (year)

Click on weiter to go to step 7.

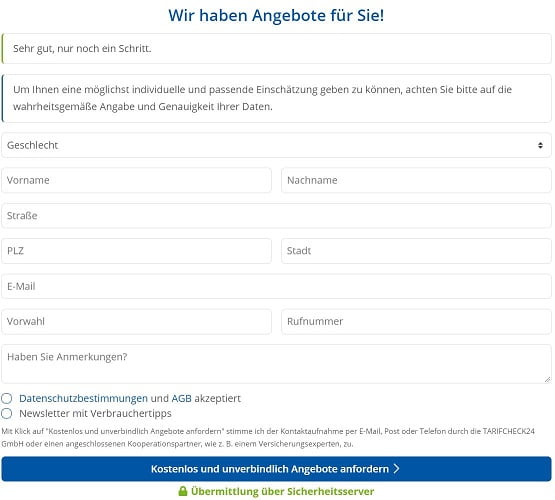

Step 7 – Request for offers for a German private health insurance – without any obligation

This is the last step. At this point you are asked to introduce a few personal and contact details. Based on your options you’ll get the best offers, for free.

There is no commitment at any point.

This is the information you need to fill in:

- Geschlecht – gender

- Vorname – surname

- Nachname – family name

- Straße – street

- PLZ – ZIP code

- Stadt – city

- Vorwahl – area code

- Rufnummer – phone number

- Haben Sie Anmerkungen? – Any comments? – Here you could mention that you don’t speak German and you want to speak to someone in your language or in English.

Before hitting compare, make sure to activate the checkmark “Datenschutzbestimmungen and AGB akzeptiert” (privacy policy and terms and conditions accepted).

Then click on the blue button: Kostenlos und unverbindlich Angebote anfordern – Request offers free of charge and without obligation

Wrap-Up

As you can see, had I know about this option of using Tarifcheck more than ten years ago, my selection of new health insurance would have been more accessible.

But still, my wife and I are happy with our current insurance, even if it’s not the cheapest one available.

There is one piece of advice for you: Make sure to think about the extras you will need and do not always choose based on pricing only.

In my opinion, having good health insurance can be beneficial in case of an emergency. I am sure you would not like to worry about coverage at that time at all.

USEFUL INFORMATION ABOUT GERMANY

___

INSURANCE IN GERMANY

> 15 types of insurance in Germany any expat should have

___

FINANCES IN GERMANY

> Find Best Rates for Loan in Germany

___

WAGES AND TAXES IN GERMANY

> Tax return Germany – Everything you need to know

> Average Salary in Germany Latest Data

___

WORKING IN GERMANY

> CV in German with Europass: How to fill in step by step

___

LEARNING GERMAN LANGUAGE

> How to learn German fast: Top 10 strategies

* The links marked in this way are affiliate links and indicate that we receive a small commission, if you decide to buy the products or services offered by our partner sites. There’s no additional cost for you. Powered by TARIFCHECK24 GmbH.