Before buying a car in Germany, you might want to know about the tax load for your new car. There is an easy way to find out with the help of a car tax calculator. I will explain this further down below in detail.

With this article on car tax in Germany, I would like to explain how the taxes are calculated in detail. As well as what it depends on, because the motor vehicle tax is different for each model.

The information in this article is mainly based on the information the Bundesministerium der Justiz about the “Kraftfahrzeugsteuergesetz” or motor vehicle tax act.

Key takeaways

1) Vehicle tax in Germany depends on factors such type of vehicle, fuel or cubic capacity.

2) The automobile tax is calculated based on four criteria.

3) It is collected automatically from your bank account.

4) If you own an electric car in Germany you don’t pay car tax.

5) You can calculate the car tax by using the car tax Germany calculator in this article.

Topics in this article

How much is vehicle tax in Germany? >>

How is car tax calculated? >>

Where to pay the motor vehicle in Germany? >>

Exemptions from vehicle tax? >>

What is the Umweltplakette in Germany? >>

Where to buy Umweltplakette in Germany? >>

Car tax Germany calculator explained >>

How much is vehicle tax in Germany?

According to §9 of the motor vehicle tax act, you can find a detailed list of costs based on the factors mentioned below.

The car tax depends on the following factors:

- “Fahrzeugart” or type of vehicle you are registering

- “Antriebsart” or drive type, meaning whether the motor is fueled by gasoline (“Benzin”) or diesel

- “Hubraum” or cubic capacity measured in ccm

- “Kohlendioxidemission” (carbon dioxide emission)

- “Schadstoffklasse” (pollutant class)

- or “CO2-Wert“ (CO2 value)

You can find these values in the „Zulassungbescheinigung Teil I“, formerly „Fahrzeugbrief“, or registration certificate part I.

How is car tax calculated?

Germany introduced a new vehicle tax system at the beginning of 2021. The novelty is that the tax rate is based on carbon dioxide emissions.

This means that they would charge cars with high fuel consumption a higher tax. So that the Germans are encouraged to buy cars that are more environmentaly friendly.

If the car has already been registered before 2021, the tax rate will stay the same.

In Germany, the vehicle tax is calculated based on the four different types of information

It starts with the classification of regular cars. Whether it’s

- an SUV

- a convertible

- hatchback

- or station wagon

The taxes are different between “Selbstzündungsmotoren”, meaning diesel engines, and “Fremdzündungsmotoren” (gasoline engines).

Per 100 ccm cubic capacity, you will have to pay a fixed price.

EXAMPLE

Your car has 1,900 ccm of cubic capacity. The base price for your diesel engine is 9.50 Euro. You will have to pay at least 9.50 Euro times x 19 = 180.50 Euros as car tax.

In addition to that, the car tax is also based on your carbon dioxide emission per gram per kilometer.

Calculation based on CO2 emissions

Taxes based on CO2 emissions are calculated using the following table:

| Emission ranges | Cost |

| Up to 95 g/km | free |

| Between 96 g/km up to 115 g/km | 2,00 Euro per g/km |

| Between 116 g/km up to 135 g/km | 2,20 Euro per g/km |

| Between 136 g/km up to 155 g/km | 2,50 Euro per g/km |

| Between 156 g/km up to 175 g/km | 2,90 Euro per g/km |

| Between 176 g/km up to 195 g/km | 3,40 Euro per g/km |

| Above 195 g/km | 4,00 Euro per g/km |

Let’s suppose your car has 155g per kilometer of carbon dioxide emission.

So in my example, you would have to pay:

20 x 2,00 Euro + 20 x 2,20 Euro + 20 x 2,50 Euro

And this until you reach the 155g/km emission rate.

40 Euro + 44 Euro + 50 Euro = 134,00 Euro

For a car with 1,900 ccm and 155g/km, you would have to pay a tax of 180.50 Euro + 134 Euro. This makes 314.50 Euro per year.

The costs are subject to change, depending on the legislation. The final tax is usually rounded down to the whole euro.

Where to pay the car tax in Germany?

After registering your car in your name, the car tax is withdrawn automatically from your German bank account.

IMPORTANT

Accounts from other countries are not allowed to be used during a used or brand new car registration.

In Germany, you only pay motor vehicle tax once a year, and you cannot switch payments to a monthly instalment.

A few weeks after you register a car in your name, you will be informed about the car tax. Since you had to provide an “Einzugsermächtigung” (direct debit authorization) for a German bank account, they will take the money from your account soon after.

Exemptions from vehicle tax in Germany?

There are a few exemptions:

- You bought a purely electric-driven car. The tax exemption is valid for exactly ten years after the car was registered for the first time. That does even apply when you buy a used electric car from a private seller or a car dealership.

- You own a particularly low-emission passenger car with compression-ignition engines. If your car meets the Euro 6 “Schadstoffklasse” and is brand new, you are eligible for a single tax reduction. You’ll pay 150 Euros if you are the first owner of the car.

What is the Umweltplakette in Germany?

The “Umweltplakette” or environmental stickers are available in three different versions:

Green Umweltplakette in Germany

The green and best sticker with the number 4 printed on it is the best one you will get as soon. As your car fulfills the respective requirements.

Yellow Umweltplakette in Germany

The yellow environmental sticker is for cars that are not as environmentally friendly.

Red Umweltplakette in Germany

And the red sticker is for cars that are the least environmentally friendly.

You may enter one of the so-called “Umweltzonen” or environmental zones only if you have a certain type of sticker attached to your windshield. With the red sticker there’s almost no chance for you to drive to these zones.

Do you see a shield as above, the colour of your sticker and the word “frei”? Then you can drive to this area. The condition is to have the sticker.

You can find more about the “Umweltplakette” in Germany on the website of TÜV Nord.

Where to buy Umweltplakette in Germany?

You can get the “Umweltplakette” (environmental sticker) in Germany at your local registration office. Usually, they offer you this sticker when registering your used or new car.

I recommend that you pay the small fee of about 5 to 8 euros. The reason for this is that you will not get into trouble if you enter a so-called “environmental zone”.

Car tax Germany calculator explained

There is an easy way to calculate your car tax based on the most recent rules and regulations. And this is the car tax calculator for Germany provided by the “Bundesfinanzministerium”.

Here is the car tax Germany calculator:

See explanation below >> Make sure you accept or deny the cookie settings of the tool.

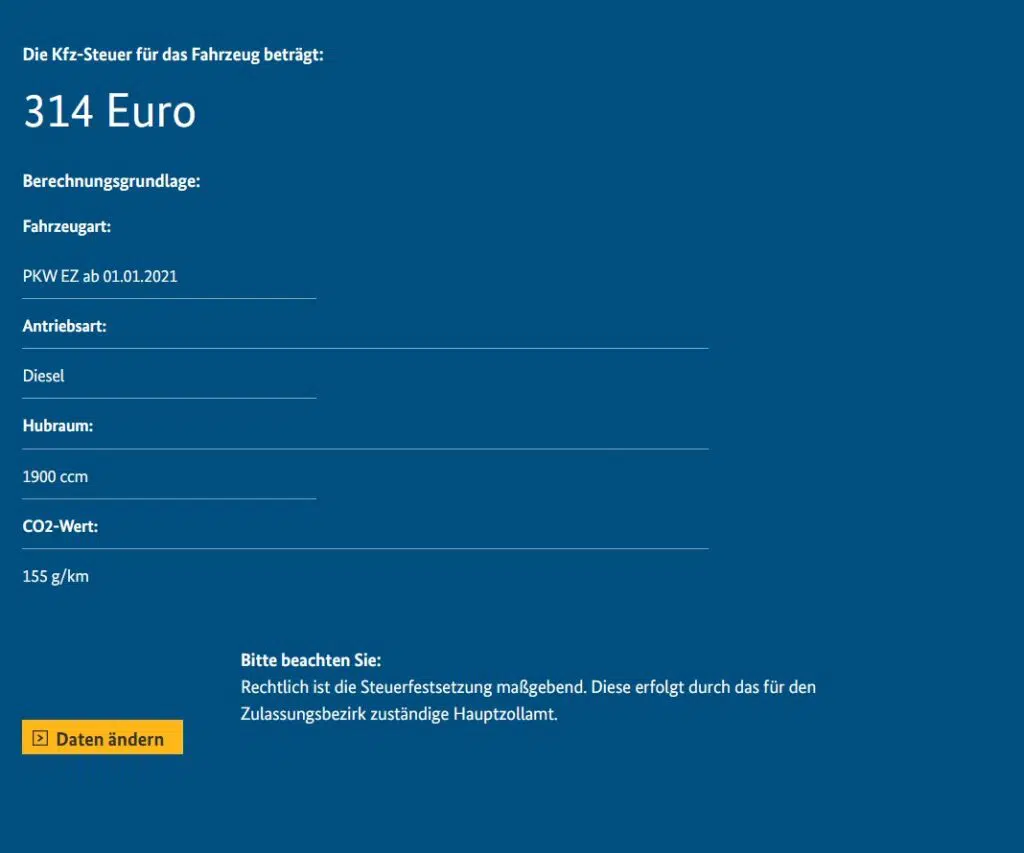

Based on the previously used example, I would like to explain how you can use the car tax Germany calculator.

Fahrzeugart – Type of vehicle

For “Fahrzeugart” (type of vehicle) choose the option that applies to you. I chose a car with a first registration date after the 1st of January 2021.

PKW EZ bis 01.11.2008 – Car with first registration until 01.11.2008

PKW EZ 05.11.2008 bis 30.06.2009 – Car with first registration from 05.11.2008 until 30.06.2009

PKW EZ 01.07.2009 bis 31.12.2011 – Car with first registration from 01.07.2009 until 31.12.2011

PKW EZ 01.01.2012 bis 31.12.2013 – Car with first registration from 01.01.2012 until 31.12.2013

PKW EZ 01.01.2014 bis 31.12.2020 – Car with first registration from 01.01.2014 until 31.12.2020

PKW EZ ab 01.01.2021 – Car with first registration after 01.01.2021

Anhänger – Trailer

Reine Elektrofahrzeuge – Purely electric cars

Motorräder – Motorbikes

Leichtfahrzeuge – Lightweight vehicles

Nutzfahrzeuge – Utility vehicles

Oldtimer

Wohnmobile – Camper vans

Antriebsart – Type of engine

As the type of engine, I chose “Diesel”.

Hubraum in ccm – Cubic capacity in ccm

And the cubic capacity of 1,900 ccm.

CO2-Wert in g/km – Carbon dioxide in g/km

The fictive “CO2-Wert in g/km” (carbon dioxide emission measured by g per kilometer) is 155 in my example.

Saisonkennzeichen – Seasonal license plate

If you are using your car only at specific times throughout the year with a seasonal license plate, you should make sure to activate the checkbox at “Saisonkennzeichen?”.

Then click on the “Berechnen” (calculate) button. By doing so, you will get the final result of your car tax displayed as seen below:

Do you need to change one or more values in your calculation? Just click on the yellow button that says “Daten ändern” (change data). And you can start from the beginning.

By using the car tax calculator for Germany, you can be sure that you get the most recent tax for your specific car. This calculation uses data you can find in your registration certificate parts I and II.

If you would like to learn more about opening a German bank account, you can find detailed information here in my detailed article: How to open a bank account in Germany.

USEFUL INFORMATION AROUND CARS IN GERMANY

> How to buy a car in Germany as a foreigner

> How To Find A Car In Germany On Internet

> 5 Steps for Registering A Car In Germany

> Buying A Car in Germany For Export

> Speeding Fines In Germany | Traffic Fines In Germany