Having legal insurance in Germany can provide you with extra peace of mind, especially when you plan on something big.

I, for example, took out my legal insurance right before I bought my house in Germany. And for possible traffic disputes.

Buying a house can be scary anyway. And it certainly is when you are not familiar with all the rules, regulations, and possible pitfalls.

So being able to get legal support is why I chose to get legal insurance. But more on that later in this article that I’d like to share with you here.

At that time, I went to a local insurance broker in my small town in Southern Germany.

But later on, I changed to a different insurance company that I am still with since then.

Key takeaways

1) Legal protection insurance in Germany assists in legal disputes.

2) It covers court costs, lawyers’ fees and criminal bail.

3) It does not cover fines, penalties or deliberate acts.

4) There are two types of legal protection insurance: private and professional.

5) I chose 3 types of private legal protection insurance: Traffic, Family, Work.

6) Legal protection insurance in Germany can cost between 26 and 43 euros per month.

7) The cheapest way to take out legal protection insurance is to use an online comparison website.

Go to Legal Insurance Calculator*

Topics in this article

Legal insurance in Germany: What is this? >>

What does legal insurance cover? >>

What is not covered by the legal insurance? >>

Types of private legal insurance >>

Types of professional legal insurance >>

Cost of legal insurance in Germany versus benefits >>

What is the best legal insurance Germany >>

Where can you purchase legal insurance? >>

Quick guide in English for the legal insurance calculator >>

How I used my legal insurance in Germany? >>

First, I had to understand what is legal insurance in Germany

Legal insurance helps with legal disputes. In doing so, the insurance enforces the interests of the insured.

Here

- court costs

- attorney’s fees (including those of the opposing party in the event of losing the case)

- and penalty bonds are covered

The German Consumer Center (Verbraucherzentrale) provides some basic information in German around legal insurance.

In Germany, legal protection insurance is typical for traffic issues and personal and/or professional cases.

The advantage is that legal protection insurance usually also applies in other European countries. Worldwide insurance coverage is also possible under certain circumstances.

This is especially interesting if you are traveling abroad for a more extended period of time.

Children are usually automatically covered, even if you are already of age. The only condition is that you are still in training or studying.

And then to find out what precisely the legal insurance covers

Private legal insurance helps to assert claims arising from contracts.

This was particularly important for me when I bought a house in Germany, as I was hardly familiar with the circumstances.

Should a contract not be fulfilled, I would have the possibility to claim the help of my insurance.

Legal insurances from the area of traffic protect you as a road user. No matter whether they are as a pedestrian, with the bicycle or motor vehicle on the way.

The legal assistance helps here with possible claims for damages from the other party involved in the accident.

Or if you want to defend yourself against the threat of losing your driver’s license.

There is also insurance for specific issues relating to tenancy and home ownership law for tenants and landlords.

Employees can also be insured separately. If they are wrongfully dismissed, legal insurance will help them to enforce their claims.

Of course, you can also combine different areas in legal insurance.

And thus cover yourself comprehensively.

For entrepreneurs, for example, a combination of private and professional insurance is worthwhile.

I also found out what this insurance doesn’t cover

Typical areas not covered by many legal insurance policies include:

- Fines or financial penalties, e.g., from road traffic

- Deeds committed intentionally

- Construction disputes or divorce disputes

- A dispute before the constitutional court or an international court of justice

- There is a 3-month time limit for certain insurance benefits. This means that at least three months must have passed since the start of the insurance.

During this process, I gathered as much information as possible

When I was looking for the best legal insurance to take out in Germany, I learned how many different types of legal protection insurance there are. I have already mentioned some of them.

My broker explained to me that there are different types of legal insurance available in Germany. To be honest, I have not purchased legal insurance from my broker at this time.

I took the time to look at all the types in more detail at home.

Please find a comprehensive list of all types of legal insurances in Germany here:

Private legal insurance Germany (Private Rechtsschutzversicherung)

Private legal insurance is the most common legal insurance that most costumers get. The Gabler Wirtschaftslexikon provides so basic information about private legal insurance in Germany.

This specific insurance is usually composed of different modules.

It consists of a unique insurance package that is tailored to your specific needs.

One or more modules of the following list are often included:

Matrimonial legal protection (Ehe Rechtsschutzversicherung)

ARAG is currently the only insurance company that offers separate coverage in the event of divorce.

Family legal protection (Familien Rechtsschutzversicherung)

This module completely covers the family. Here one should inquire well whether in the case of divorce, legal disputes are likewise covered or rather not.

For families, this option is mandatory. Good tariffs are available already from 15 Euros per month, according to TarifCheck*.

Inheritance legal protection (Erbrechtsschutzversicherung)

Another essential topic can arise within the family. If it is about inheritance, disputes are almost pre-programmed. These insurance policies are usually correspondingly expensive.

Traffic legal protection (Verkehrsrechtsschutzversicherung)

If you find yourself in a situation where you have to settle traffic law issues in court, an insurance policy with this option can be helpful.

Even if you don’t drive a car, it can be worthwhile to take out such insurance.

You are also covered as a cyclist or pedestrian.

Legal insurance for tenants (Wohnrechtsschutzversicherung)

Conflicts often arise in connection with rental issues.

Insurance can help when disputes arise with:

- landlords

- property managers

- or neighbors

Landlords can also take out their own legal protection insurance, which will step in when there are difficulties with tenants.

Employment legal protection (Berufsrechtsschutzversicherung)

This coverage is available as a tariff with private legal protection insurance. Only employees and civil servants can book this tariff.

If you are an executive or manager, there are separate tariffs that cover possible disputes better.

Professional legal insurance (Berufliche Rechtsschutzversicherung)

Corporate legal protection (Unternehmensrechsschutzversicherung)

For the commercial sector, there are so-called company legal protection packages. This insurance is helpful if your employees get involved in a legal dispute in the course of their work.

Employers are also covered in case of disputes with their employees.

Legal insurance for builders (Rechtsschutzversicherung für Bauherren)

Construction projects are often a case of disputes. Builders are constantly affected by findings of defects by buyers, for which they themselves are usually not responsible. There are very few insurance policies that cover a construction project.

In this case, it is necessary to take out appropriate insurance before construction work begins.

Legal protection for leases (Rechtsschutzversicherung für Verpächter und Pächter)

The final form of legal protection insurance covers all issues related to leasing agreements. This applies to both the lessee and the lessor of a plot of land or property.

Costs of legal insurance Germany versus benefits – is it really worth it?

It is difficult to answer the question of whether legal protection insurance is worthwhile.

The feeling of being covered in the event of an emergency can be very reassuring.

I myself have never regretted taking out legal insurance, even though I have only used it once so far.

At that time, when I talked to my insurance broker, he provided me a simple example for a not so unusual case for legal insurance:

Here is an EXAMPLE

Imagine you have an accident in traffic with a cyclist. The cyclist is injured, hospitalized, and requires treatment. In addition to his absence from work, you receive a claim for damages of over 15,000 Euros from the other party’s insurance company.

However, you are of the opinion that the claim is not justified because the cyclist acted contrary to traffic regulations. You want to contest this claim, and you do not get any support from your car insurance.

Here, legal protection insurance can help clarify the case for you and enter into a possible court hearing. If you had to pay for the lawyer’s fees and court costs yourself, the total costs would quickly exceed 20,000 euros.

Types of legal insurance important for me

Then, he presented me some different types of insurances that had all the benefits that were important for me:

- Private legal insurance

- Traffic legal protection

- Family legal protection

- Employment legal protection

Based on information from the Ärzteblatt I chose both of the most common types of legal insurance in Germany. They highly recommend getting legal insurance for traffic and employ.

The monthly tariffs he presented varied between 26 Euros and 43 Euros at that time. Their difference was between the additional extras they provided.

The more expensive one from ARAG provided extended criminal legal protection (Erweiterten Straf-Rechtsschutz), and it had a slightly higher deductible between 150 – 300 Euro. But there were some additional benefits like a lower waiting period.

Especially the lower waiting period was essential for me at that time as I was right before buying my first house in Germany. And in case my wife and I would have kids, they would be covered as well.

In my situation, being an ex-pat and traveling back home every once in a while, it was also crucial that they also covered international claims.

Why do Germans take out this type of insurance?

Let me provide you with some statistics regarding legal insurance in Germany.

Statistics show that around 22.64 million people in Germany have taken out traffic legal insurance. For good reason, because personal injury and property damage can quickly become expensive in road traffic.

Around 49% of people over the age of 18 said in 2017 that they had legal insurance for their household.

Typical claims for legal insurance, moreover, are:

- Unjustified dismissals by the employer

- Disputes with the landlord

- The enforcement of a claim for damages

But even simple neighborhood disputes can end up in court if the fronts are hardened.

If you’re wondering what is the best legal insurance Germany

The best legal insurance in Germany is always legal insurance that covers as many everyday needs as possible at a reasonable monthly tariff.

But you should make sure that you have a detailed look at each individual insurance first before taking out legal insurance.

In my case, the choice fell on the best legal insurance at that time, ARAG. The offer was not the cheapest on the market at that time, but the comprehensive insurance coverage made my choice easy.

So you should pay close attention to your coverage wishes and not forget them when you make your selection.

Due to a large number of offers from the best legal insurance companies in Germany, this can be very challenging.

It was beneficial for me to use TarifCheck’s rate check on the best legal protection insurances in Germany.

This is where you can purchase legal insurance in Germany

There are several options where you can buy legal insurance in Germany. I do not recommend a local insurance broker because of limited offerings and the difficulty of comparing things during a consultation.

It’s better to check different insurance companies either on their websites or to start a comparison with TarifCheck*.

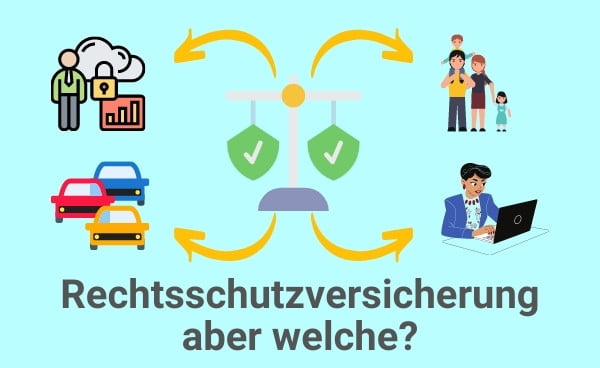

If you want to compare some prices, you can use the online calculator from TarifCheck*

I did some research before writing this article, and there is no better legal insurance calculator out there than the one of TarifCheck in Germany. In the following steps, I will explain how the legal insurance calculator works and what those special terms mean in English.

A quick guide in English for the legal insurance Germany calculator

Where to start

First, visit the page about legal insurance from TarifCheck*, a company of Check24:

First, you can choose between four standard insurance packages:

- Privat: private legal insurance

- Beruf: employment legal protection

- Verkehr: traffic legal insurance

- Wohnen: legal insurance for tennants

After you choose, you’ll push the button “Jetzt Rechtsschutzversicherungen vergleichen” (Compare now legal insurance offers).

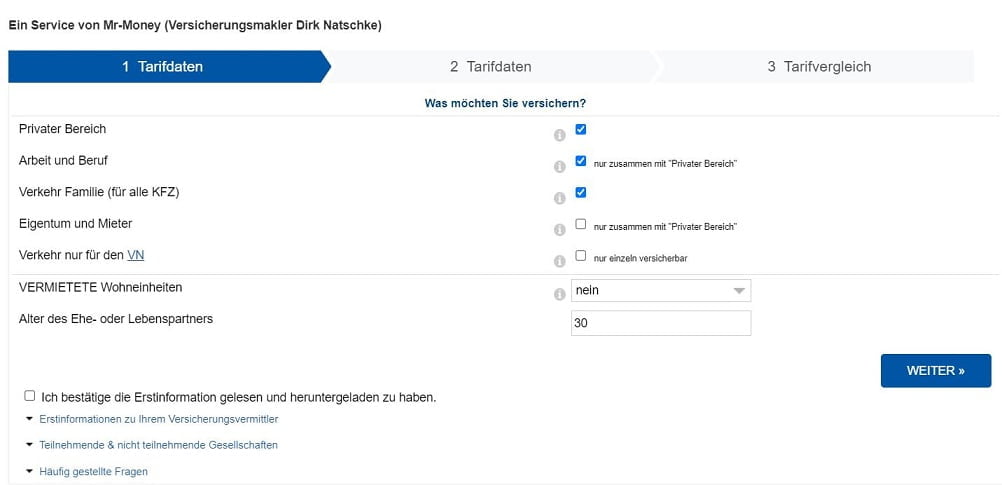

Tariff data 1

You will then have to choose between several legal insurance packages, such as:

- Privater Bereich (legal insurance for private scope)

- Arbeit und Beruf (legal insurance for work area and job purposes) – this only works in combination with “Privater Bereich”

- Verkehr und Familie (für alle KFZ) (Traffic and family (for all cars))

- Eigentum und Mieter (Property and tenants) – this also works only in combination with “Privater Bereich”

- Verkehr nur für den VN <Versicherungsnehmer> (Traffic only for the insured)

- Vermietete Wohneinheiten (Rented residential units). If you don’t have rented units, you choose “nein” no. If yes, you can choose from the list how many you have.

- Alter des Ehe- oder Lebenspartners (Age of the spouse or partner)

After you have chosen your options, you click on “Weiter” (continue). Make sure you have also read the conditions and check the box.

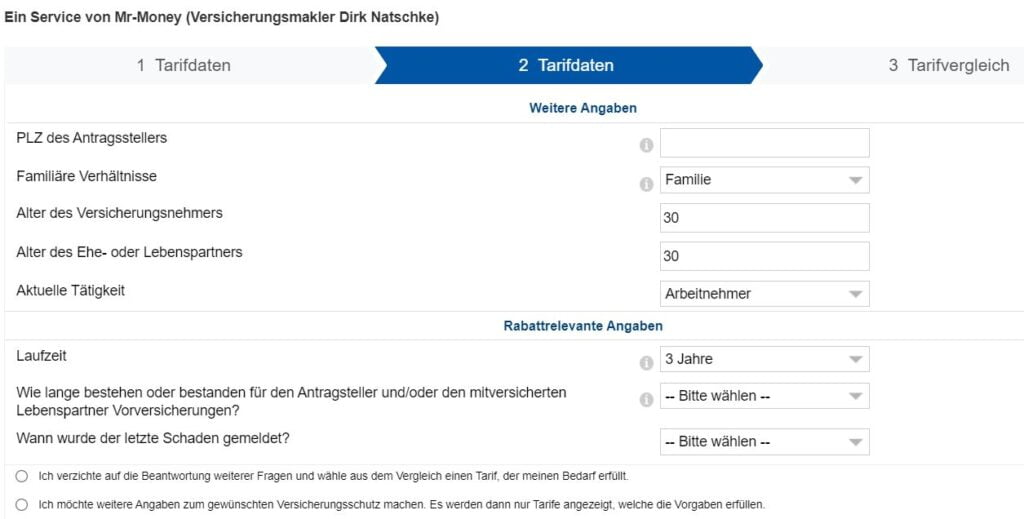

Tariff data 2: Personal data and further options

Add in your current zip code (Postleitzahl)

Family situation (Familiäre Verhältnisse). Here you can choose between:

- Familie (Family)

- Paar (Couple)

- Single

- Alleinerziehend (Single parent)

Add the age of the policy holder (Alter des Versicherungsnehmers)

Also add the age of the spouse or partner (Alter des Ehe- oder Lebenspartners)

In the next dropdown you are asked about your current employment status.

The preselected option is employee (Arbeitnehmer). The other options to chose from are:

- Unemployed (Ohne berufliche Tätigkeit)

- Public Service (Öffentlicher Dienst)

- Self employed/Freelancer (Selbstständig/Freiberufler)

- Permanently no longer employed (Auf Dauer nicht mehr erwerbstätig)

- Trainee/Student (Azubi/Student)

In my case I chose “employee” (Arbeitnehmer).

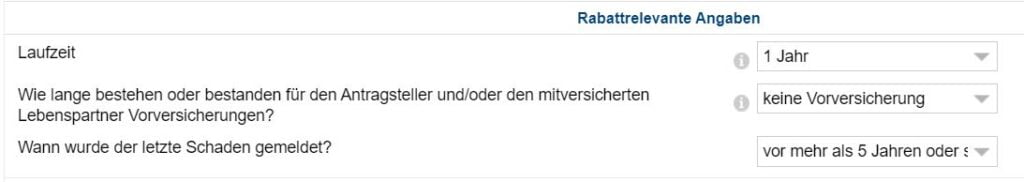

In the next field you have to set the duration (Laufzeit) of the contract. I chose 1 year.

As I have never had a legal insurance before, I also chose “keine Vorversicherung” (no previous legal insurance). If you choose this you’ll also choose that you never reported damages: “vor mehr als 5 Jahren oder schadenfrei”(more than 5 years ago or free of damage).

I personally wanted to get an overview of the offers, so I chose not to answer any detailed questions (see above).

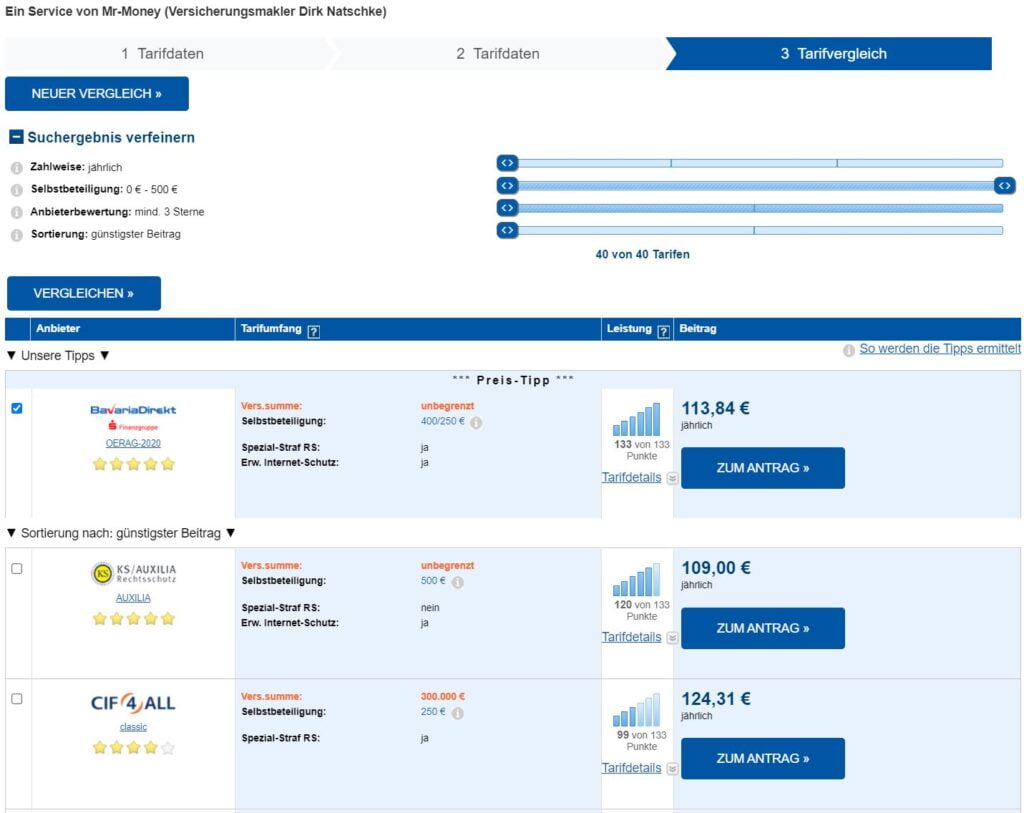

Search Results

You will now be presented with a list of results based on your selections on the previous screen.

You usually see the best tariff at the top first position based on price and service.

At the top of the list you can fine tune your selection by choosing:

- Payment option (Zahlweise): I choose always “jährlich” (yearly) because is the cheapest.

- Selbstbeteiligung (Deductible): Between 0 € to 500€. I usually choose 200 – 250 € as the yearly rate is lower

- Provider rating (Anbieterbewertung). I choose at least 3 stars.

- Sortierung (Listing): I would recommend to stay with the pre-set option, günstigster Betrag (cheapest tariff)

Having made your choice, it’s now a good time to click on ZUM ANTRAG (to the contract). You will then be forwarded to new page, where you have to introduce your personal data.

By the way, I only used my legal insurance once

I only used my legal insurance when I had some legal questions and wanted to speak to a specialist. I never considered suing someone even if I have some annoying neighbors – but who does not have those?

When I needed advice from my insurance, it went well.

I did not have to pay anything extra because I could explain the facts of the case to a lawyer from their side by a simple phone call.

Was it worth having legal insurance so far? In my case, I could have quickly gone to a local lawyer and ask him for advice. But who knows what could have happened in addition to that?

I would not be eager to cover court costs and attorney fees on my own if something serious happens to my family or me.

Good to know

So even if you are considering getting legal insurance at your local broker’s office, I can still recommend looking at TarifCheck* first:

They have the best and most comprehensive overview of the best legal insurances in Germany, and you can easily compare tariffs by following the steps above.

USEFUL INFORMATION ABOUT GERMANY

___

INSURANCE IN GERMANY

> 15 types of insurance in Germany any expat should have

___

FINANCES IN GERMANY

> Find Best Rates for Loan in Germany

___

WAGES AND TAXES IN GERMANY

> Tax return Germany – Everything you need to know

> Average Salary in Germany Latest Data

___

WORKING IN GERMANY

> CV in German with Europass: How to fill in step by step

___

LEARNING GERMAN LANGUAGE

> How to learn German fast: Top 10 strategies

* The links marked in this way are affiliate links and indicate that we receive a small commission, if you decide to buy the products or services offered by our partner sites. There’s no additional cost for you. Powered by TARIFCHECK24 GmbH.