Having accident insurance in Germany (Private Unfallversicherung) makes perfect sense for many.

Unfortunately, there are always cases where people get into financial problems after an accident.

Most because they are not insured beyond the statutory accident insurance.

If you like to do sports in your free time, you should consider taking out private accident insurance. Statutory variant only covers accidents at work or in kindergarten, school or university.

Private accident insurance ( Private Unfallversicherung) also provides enough accident protection

- in leisure time

- in traffic

- or at home

Key takeaways

1) There are two forms of accident insurance in Germany: statutory accident insurance and private accident insurance.

2) The statutory accident insurance is part of the social insurance.

3) The private accident insurance (Private Unfallversicherung) is not a compulsory insurance, but a voluntary insurance

4) A private accident insurance additionally covers accidents in private life. It should also be taken out by the self-employed.

5) Experts recommend private accident insurance for freelancers and outdoor enthusiasts.

6) Private accident insurance in Germany covers all accidents during and outside of work.

7) The easiest way to take out such insurance is with an online calculator.

Go to accident insurance calculator >>

Read our FULL GUIDE on how to take out Accident Insurance in Germany without speaking German >>

Topics covered in this article

Main types of accident insurance >>

Private accident insurance: The main differences to the statutory accident insurance >>

Who needs private accident insurance in Germany? >>

What is covered with the private accident insurance? >>

What does the private accident insurance cost? >>

A complete guide on how to take out a private accident insurance in Germany online >>

Main types of accident insurance in Germany

In Germany, there is a general distinction between two different forms of accident insurance:

- Statutory accident insurance pays for accidents at work, kindergarten, school, or university.

- Private accident insurance goes beyond this and covers leisure time and sometimes even vacations.

You will learn more about the differences in the next two chapters.

Statutory accident insurance Germany – short explanation

Statutory accident insurance is a branch of social insurance.

This compulsory insurance compensates for health damage suffered during professional or school activities.

If something happens, the aim is to restore health and performance.

The goal is to compensate the insured persons or their surviving dependents.

All employees and trainees are included in the statutory accident insurance. Children in kindergartens and daycare centers, as well as pupils and students, are also automatically covered by it.

This also applies to:

- persons on family farms

- domestic caregivers

- unemployed

- and volunteers like firefighters and rescue workers.

Private accident insurance Germany – short explanation

Private accident insurance is a voluntary insurance that does not have to be taken out on a mandatory basis.

In many cases, it is nevertheless advisable to take out private accident insurance.

The differences between private and statutory accident insurance can be decisive in some cases.

It also protects against getting into financial difficulties in the event of an accident. It provides some financial stability in the event of death for the surviving dependents.

Read our FULL GUIDE on how to take out Accident Insurance Germany without speaking German >>

Private accident insurance: The main differences to the statutory accident insurance

Coverage

Statutory accident insurance covers only the journey to and from work, as well as working hours or time spent at kindergarten, school, or university.

Private accident insurance additionally covers accidents in private life and should also be taken out by the self-employed.

What many people do not know, however, is that in addition, the benefits of private insurance are also higher or longer.

Degree of disability

If only a low degree of disability is reached due to an accident, the private accident insurance already steps in at the 1%.

The statutory insurance pays here only from 20%.

Amount of the benefit

The amount of the benefit is also different:

The statutory accident insurance measures the payments on the average salary of the past 12 months.

With private accident insurance, you can define the payments yourself.

You should only note that a higher sum insured automatically leads to higher premium payments.

Occupational Diseases

Statutory accident insurance, on the other hand, covers occupational diseases, which private accident insurance does not.

Pension

The last difference lies in the pension change after an accident:

If you experience an improvement in your level of disability years after an accident, the pension payment remains the same with private accident insurance.

Here, the statutory accident insurance would ask you to re-determine the degree of disability.

Read our FULL GUIDE on how to take out Accident Insurance Germany without speaking German >>

Who needs private accident insurance in Germany?

Private accident insurance is important for everyone who works independently as a freelancer.

It is also important for people who want to insure themselves in the event of accidents in a private environment, such as:

- at home

- practicing sport activities

- during leisure time

- or even on vacation

Around 70% of all accidents happen during leisure time, according to the baua.

The form of insurance can be worthwhile especially when

- you are retired

- for families where only one earner provides the necessary income

- or young people who are more often active in sports

Private accident insurance is also recommended for housewives and househusbands, as well as people who practice a hobby with a particular accident risk or people without a profession.

What is covered with private accident insurance in Germany?

This type of insurance in Germany covers all accidents inside and outside work.

An accident is defined as a sudden event that must have occurred within a short period of time.

Permanent stress, e.g., in sports, or other pathological disorders such as excitement are not covered.

In addition, all events acting on the body from the outside are covered.

Typical examples here are

- either falling objects

- or, for example, injuries in road traffic

The decisive factor here is always that the accident occurred involuntarily. Even grossly negligent behavior is covered by it in Germany. Of course, I do not recommend anyone negligently endanger their health or life.

Additional benefits of private accident insurance

In addition to these standard services listed above, additional services can often be agreed upon.

These are, for example:

- death benefit (applies only to accidents)

- daily sickness benefit

- daily hospital benefit

- convalescence benefits

- and transitional benefits

In addition, an accident annuity can be agreed upon, which takes effect from a degree of disability of 50. There are also special tariffs with higher benefits for serious accidents.

What does private accident insurance cost in Germany?

The prices for this type of private insurance in Germany depend heavily on age and the scope of benefits.

Favorable rates can start as low as 2 euros per month for 14-year-olds, for example, whereas more expensive rates for adults with a high level of coverage can readily cost up to 40 euros per month.

Since there are 202 insurance companies offering accident and damage insurance in Germany, it is worthwhile to carry out a detailed insurance comparison.

A complete guide on how to take out online private accident insurance

To make the comparison among private accident insurances in Germany as easy as possible for you, you will find a step-by-step guide with explanations of the individual terms here:

Step 1 – How many persons should be insured

In the highlighted area, select the number of persons insured (Personenanzahl).

Then click on the blue button that says compare rates now (Jetzt Tarife vergleichen).

Step 2 – Desired insurance needs

Based on the information you provide, the type of coverage you require will be determined according to your personal needs.

At this step you have to provide following information:

- ZIP code (PLZ des Antragstellers)

- Desired starting date of the accident insurance (Gewünschter Versicherungsbeginn)

- Applicant’s pay scale group for people working in public service (Tarifgruppe des Antragstellers Öffentlicher Dienst)

- Insurance period – You can choose between 1 year or 3 years. Choosing 3 years you will get 10% off

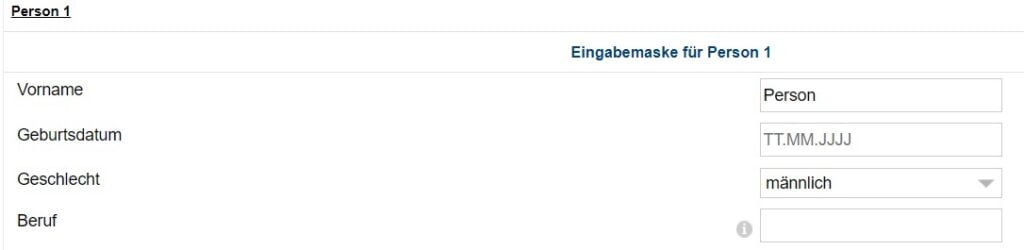

Step 3 – Entering personal data for accident insurance calculator Germany

Enter your first name

Vorname = first name in German

Fill in your date of birth

You should enter your date of birth in the following format: DD.MM.YYYY (TT.MM.JJJJ).

Your gender

Geschlecht = gender in German

Choose between männlich (man) or weiblich (woman).

Details about your occupation

The next form field allows you to start a search for your occupation (Beruf).

Please make sure to use Google Translate or Deepl.com to find your German equivalent first.

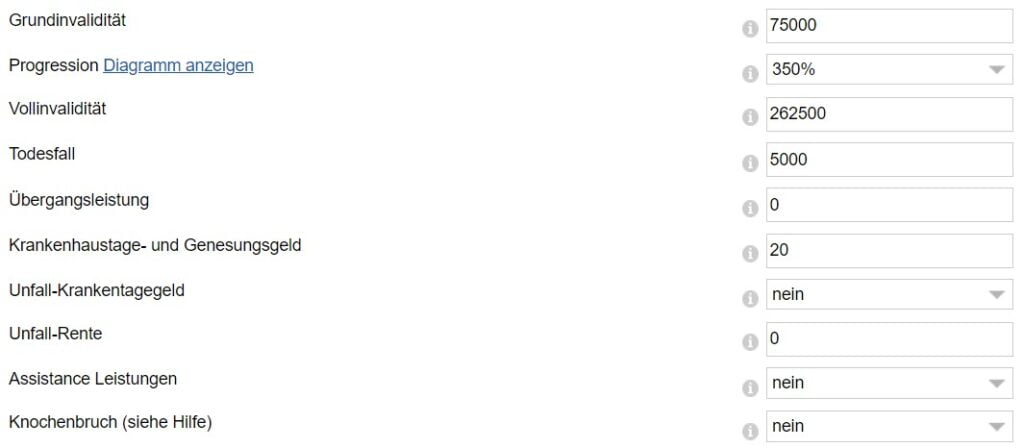

Step 4 – The basic parameters

In the following fields they ask you to define the basic parameters of your private accident insurance:

Grundinvalidität – Basic disability

For the basic sum (Grundinvalidität) you should select at least € 200,000 as of the coverage sum if you are a salaried employee with an office job.

If you earn more than € 66,666 gross per year, you should enter your 3-fold annual income as the basic sum.

Progression

A value of 225% is recommended as the progression (Progression).

This increases the payout amount in case of a severe disability, such as the loss of both legs.

Vollinvalidität – Full disability

Below this point, at Vollinvalidität you can see what payout you would receive in this case, if you have the highest degree of invalidity.

Todesfall – Death

You can then specify the amount to be paid out if death occurs.

More than 5,000 € in coverage sum is also not recommended here.

This sum usually covers all or most of the costs of a funeral.

On the other hand, to provide sufficiently for the surviving dependents, we recommend to take out an appropriate life insurance policy.

Übergangsfall – Transitional service

As a rule, this benefit is paid after 6 months. The benefit is paid if the physical and mental capacity has been affected by at least 50%.

Krankenhaustage- und Genesungsgeld – Hospital allowance and convalescence allowance

In the event of hospitalization following an accident, the agreed daily hospital allowance is paid for each day.

However, since the daily hospital allowance is capped by law at 10€ per day, it is not recommended to take it out with this insurance.

Unfall-Krankentagegeld – Accident sickness daily allowance

According to Tarifcheck, after an accident, you will receive this amount every day. Regardless of whether you are in hospital or on sick leave at home.

Unfall-Rente – Accident pension

Tarifcheck does not recommend this option. After an accident, the agreed pension is paid for life, but only from a degree of disability of 50 percent. But it’s very expensive to be insured, they say.

The selection of the lifelong monthly accident pension (Unfallrente) is not recommended. Besides there is also for this a better insurance, the occupational disability insurance in Germany.

Assistance Leistungen – Assistance services

The following services could be covered:

- Meal service

- apartment cleaning

- ride service to doctors/offices

- 24-hour nursing emergency call

- day and night watch for 48 hours

- pet care

Knochenbruch – Bone fracture

This option is also not recommended by Tarifcheck.

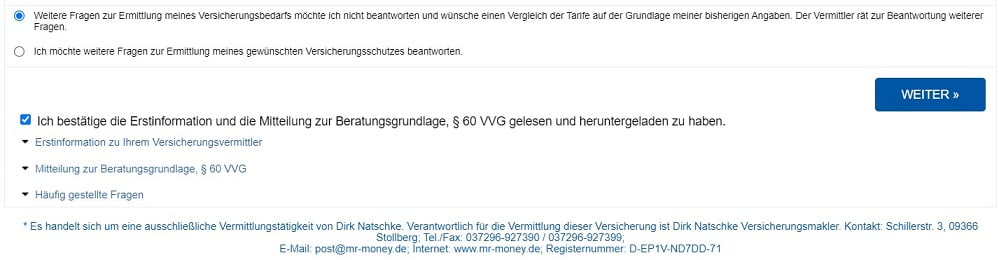

After checking the first option below the field Knochenbruch and after you confirm that you have read the terms and conditions, click on Weiter (continue). In this way, you’ll then go to the selection of the offers.

Step 5 – Select the best tariff for you

You’ll then get an overview of the best tariffs.

At the top of the page they usually display their recommendations (Preis-Leistungs Tipps).

Then the tariffs are sorted by price (from lowest to highest).

However you can change this, if you want.

The next step from here is to push on “Zum Antrag” (Order) button, of the respective provider.

Wrap up

Having private accident insurance is highly recommended.

It covers everything in case of an emergency that happens outside of work/school hours or on the way there.

The most frequent accidents happen during leisure time, during private sports, or at home.

If you want to be additionally covered here, you should use the insurance comparison of Tarifcheck*.

That way you can easily find the right tariff for you.

USEFUL INFORMATION ABOUT GERMANY

___

INSURANCE IN GERMANY

> 15 types of insurance in Germany any expat should have

___

FINANCES IN GERMANY

> Find Best Rates for Loan in Germany

___

WAGES AND TAXES IN GERMANY

> Tax return Germany – Everything you need to know

> Average Salary in Germany Latest Data

___

WORKING IN GERMANY

> CV in German with Europass: How to fill in step by step

___

LEARNING GERMAN LANGUAGE

> How to learn German fast: Top 10 strategies

* The links marked in this way are affiliate links and indicate that we receive a small commission, if you decide to buy the products or services offered by our partner sites. There’s no additional cost for you. Powered by TARIFCHECK24 GmbH.