Just recently, my family and I decided to make a life insurance in Germany. In case one or both of us parents die, our kids or the other partner including the kids is covered for a long time.

For us as foreigners living in Germany, it was very confusing to find good insurance for our needs.

There are so many insurances and different insurance models to choose from.

But with the help of one German website, we were able to find the best life insurance for our situation.

But more on that later.

About life insurance in Germany

In general, having life insurance is beneficial, depending on your life situation.

We learned that most Germans start thinking about life insurance when they are either married, have kids, or make a bigger investment.

Those investments can be something like buying a house or apartment. That way, they ensure that their significant others are not burdened with the costs of their loan if they were to die.

At the same time, it’s very often better to start with paying for life insurance at an early age.

By doing that, you can get a better insurance rate in Germany from a competitive insurer.

When talking about life insurances in Germany, three important terms are used:

- “Prämie” means “insurance premium” and is usually made up of a cost and a risk component

- “Beitrag” or Fee is the amount to be paid monthly, quarterly, half-yearly, or annually.

- The “Police” is the insurance certificate.

Key takeaways

1) In Germany, the notion of term life insurance is a form of provision for surviving dependents.

2) About 1/3 of all Germans have some form of life insurance.

3) People who need life insurance include: Families, main earners, self-employed and borrowers.

4) There are 6 types of life insurance in Germany – you can find them all below.

5) People make 4 types of mistakes when it comes to life insurance. The most common one is taking out an endowment policy

6) The easiest way to buy this type of insuanrce is to use an insurance calculator.

Go to Life insurance Calculator Germany Tarifcheck* >>

Go directly to our FULL GUIDE on how to fill in the life insurance Germany calculator without speaking German >>

Topics covered in this article

Life insurance in Germany – Risikolebensversicherung – What does life insurance mean? >>

How common is life insurance? >>

Who are the people who need life insurance in Germany? >>

Who are the people who don’t need this type of insurance? >>

How many types of life insurance are there in Germany? >>

The easiest way to get life insurance in Germany >>

Life insurance calculator by Tarifcheck* explained >>

Go directly to our FULL GUIDE on how to fill in the life insurance Germany calculator without speaking German >>

Life insurance in Germany – Risikolebensversicherung – What does it mean?

The term life insurance (Risikolebensversicherung) is a form of provision for surviving dependents. With it, you secure your family in the best and most individual way possible. You can also cover real estate financing or other loans with it in the event of your death.

When you have your own company, you can financially protect it with a term life insurance policy.

In case you die, your business partner or important employee can take over the business without a huge loss. The payout amount, known as the sum insured, can be used to pay current expenses.

Those could be for example loan installments from real estate financing.

According to Gabler Wirtschaftslexikon, with a term life insurance some problems could be involved.

A life insurance with pre-payment until death is often criticized for the so-called overpayments. People who die later may have paid with this plan more contributions than the sum of the insurance.

To avoid overpayments, shortened periods of payment are agreed on.

How common is this insurance in Germany?

According to a statistic from Statista the life insurance share in Germany was in 2019 at 32.7 percent. So almost 1/3 of all Germans do have one form of life insurance.

Compared to the most recent numbers in the US, it’s a quite low percentage. In 2021, about 52 percent of Americans owned life insurance according to Statista.

Life insurance might be more expensive in the US than in Germany, but it’s probably more important.

For example, Social Security only pays a death benefit of $255 for qualifying seniors. That’s way too little to cover average funeral costs of around $10,000.

The situation is not much different in Germany since 2004.

The former “Sterbegeld” (death or funeral benefit) was abolished. The state support has been at up to 1050 € in case of death until 2004.

On the other hand, funeral costs in Germany are only at about 75% of the price compared to the US.

Who are the people who need life insurance?

In short, life insurance is particularly useful for

- young families

- main earners

- self-employed

- and borrowers

Go directly to our FULL GUIDE on how to fill in the life insurance Germany calculator without speaking German >>

According to information from the city of Berlin, term life insurance can also be used to cover business costs if you are opening a business with a partner.

A payment to surviving dependents is only made in the event of death in the form of an agreed death benefit.

Term life insurance is not intended to provide coverage for old age.

The better choice would be to choose an endowment life insurance.

Life insurance is recommended for borrowers that have financing or load because if they die, the surviving dependents can use the death benefit to pay off the load.

Even for unmarried people in a relationship, life insurance can be helpful.

Usually, their partners are left out of the statutory widower’s or widow’s pension plans.

That way, life insurance can help cover expenses for funerals and more.

I also recommend older adults consider life insurance if they have little or no savings at all. It should at least be large enough to cover funeral costs.

Who are the people who don’t need this in Germany?

There are certain types of people who are not recommended to get life insurance:

Those are on the one hand students, trainees, and apprentices.

On the other hand, people without a partner or surviving dependents will not need life insurance in Germany either.

Also, if both partners are used to cover their own living standards, life insurance is not needed as well.

But even if you are a student, trainee, or apprentice, it can be beneficial to close life insurance at an earlier age.

The earlier you start paying your life insurance, the lower the fee is.

How many types of life insurance are there in Germany?

In Germany, the life insurance offerings are diverse and sometimes not recommended. More recommendations later in this article.

Type 1 – Endowment life insurance (Kapitallebensversicherung)

General life insurance does have some advantages compared to the other types of insurance.

The most demanded life insurance policy is the endowment life insurance policy.

It offers double security: provision in the event of death as well as payment of the saved capital at the end of the contract.

Go directly to our FULL GUIDE on how to fill in the life insurance Germany calculator without speaking German >>

The least term of 12 years is recommended for tax reasons.

It is worth considering for anyone who wants to provide for themselves in old age and for their dependents in the event of death.

But be aware of a few downsides:

Endowment life insurance policies can sometimes involve rising fees or little guarantees.

In comparison to that, it may be helpful to take a closer look at the term life insurance.

Type 2 – Term life insurance (Risikolebensversicherung)

Term life insurance helps to provide your family with financial security in the event of your death.

In this way, the surviving dependents do not get into financial difficulties.

Banks like to use term life insurance as collateral for loans.

If you should die, the loan can be paid with the payout sum.

While term life insurance only pays when you die, three other types of insurance policies pay when the policy ends.

Let me explain to you in the upcoming paragraphs three more life insurance policies.

Type 3 – Fund-linked life insurance (Fondsgebundene Lebensversicherung)

Fund-linked life insurance is a very attractive form of private old-age provision and protection for surviving dependents.

It offers good return opportunities with risk protection and is recommended for anyone who wants to provide for old age.

Type 4 – English/British life insurance (Englische / Britische Lebensversicherung)

English life insurance is a good way to save capital for private retirement. The principle is the same as for endowment insurance:

A certain amount is paid into the insurance policy each month. That way the saved capital, including the return, can be paid out at the end of the agreed contract term.

The term is limited and can be set at a good 30 years.

As a rule, the capital sum is paid out until the age of 75 is reached. The return is significantly higher, as the majority of the contributions (up to 80%) are invested directly in shares.

In Germany, the share proportion is a maximum of 35%.

The difference is that you take out an insurance policy with a British insurance company, which also makes its products available on the German market.

Type 5 – Death benefit insurance without health check (Sterbegeldversicherung ohne Gesundheitsprüfung)

Even so, the death benefit insurance is not really life insurance, it’s a boiled-down insurance to cover funeral costs.

Except for a few privileged groups, everyone has to take care of their own death.

Go directly to our FULL GUIDE on how to fill in the life insurance Germany calculator without speaking German >>

As already mentioned, the funeral benefit from the state was abolished.

Even if you are not considering getting life insurance (which is what I recommend), you should at least think about getting death benefit insurance.

Type 6 – Pension insurance (Rentenversicherung)

The statutory pension insurance is a branch of the German social security system. It is a part of the social insurance and thus serves as a retirement provision.

In addition to statutory pension insurance, there is also private pension insurance.

The statutory pension insurance is mainly intended to provide financial security for working people in old age and is also called old-age pension.

In addition, pension insurance also covers the risk of reduced gainful employment.

The third part of the pension insurance is the survivor’s pension, which is also called the widow’s pension.

Common mistakes people do

Mistake No. 1 – Cancellation of an old life insurance policy

Anyone who cancels their life insurance policy actually always pays more: savers lose their acquisition costs and forfeit the bonus at the end of the policy term.

Contracts from the 1990s also lose a good interest rate on savings – and for contracts from 2008 onwards, there is even a cancellation fee.

Go directly to our FULL GUIDE on how to fill in the life insurance Germany calculator without speaking German >>

Mistake No. 2 – Closing of an endowment insurance policy

In my opinion, an endowment policy is not the greatest idea.

It doesn’t seem to be a profitable investment for retirement provision.

By the way, unit-linked life insurance is even less recommendable than classic endowment insurance because it passes on the risks of the stock market to the customer, but usually includes even more costs than endowment insurance.

Even so the British life insurance model sounds attractive, I personally would not recommend getting one because of the exact same reason.

Mistake No. 3 – Covering a wrong payout sum

The amount that should be covered depends on the situation.

Childless couples should cover approximately one to two years’ net income.

For families, it should be two to four years’ net income, perhaps more if the children are still young.

Term life insurance is designed to give survivors a fresh start.

Therefore, a family with one main earner and two children aged three to five should consider a sum insured of about 500,000 euros.

Mistake No. 4 – Incorrect information when taking out life insurance

Incorrect information can lead to the insurer not paying or only paying in part in the event of death.

Therefore, customers should make sure that they do not violate their pre-contractual duty of disclosure.

If a suicide occurs within the first three years of the contract, the insurance company does not have to pay either.

LIFE INSURANCE CALCULATOR:

The easiest way to get life insurance in Germany

After covering all that crucial information, the question is how to find the best life insurance companies in Germany.

You will want to make sure that you get the best policy for your situation.

The way I was able to find the best insurance for my family’s situation was by using the life insurance online calculator from Tarifcheck*.

Let me explain this calculator in detail to you.

I will also provide the most important German terms that you will need during the process.

Life insurance calculator by Tarifcheck explained

The life insurance calculator for Germany compares 250 different policies and shows you the best options when you answer a few important questions.

A good way to start with finding the best life insurance in Germany is to begin here.

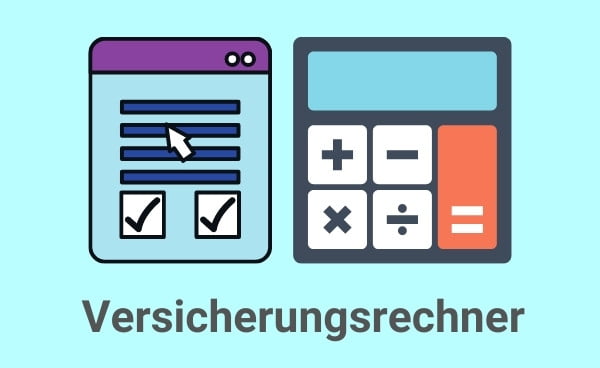

Step 1: Choose date for start of life insurance

The first step is to decide when the protection given by the life insurance will start.

It can only be the first of the month. Also the starting date cannot be more than 6 months on the future.

Enter the date in the following format: DD/MM/YYYY (in German: tt.mm.jjjj).

Push then on th button “Start Angebot anfordern” (Start quote request) to go to the next step.

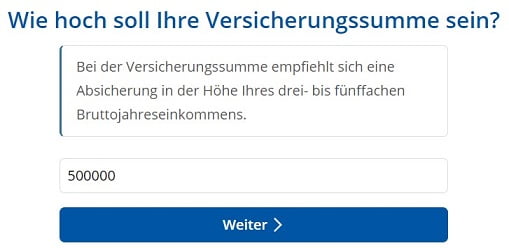

Step 2: Set the amount for life insurance cover

Now you need to set the amount for the life insurance coverage.

The question you need to answer in German is: “Wie hoch soll Ihre Versicherungssumme sein?” How much should your coverage amount be?

Tarifcheck recommends to have coverage in the amount of your three to five times gross annual income.

Click on “weiter” to move to the next step.

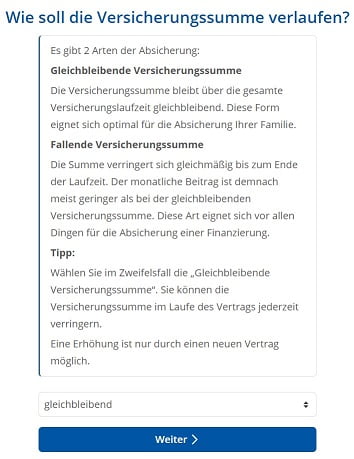

Step 3: Fixed or decreasing insurance payout?

Then it’s time to choose, whether you would like to have a

- fixed insurance payout (“Gleichbleibende Versicherungssumme”)

- or a decreasing insurance payout (“Fallende Versicherungssumme”).

The latter one would make sense if you want to cover a loan that you have to pay off.

Again, choose the one that applies best for your situation.

Choose “gleichbleibend” if you plan to cover the living expenses of your partner and kids if you die, for example.

Push then on “weiter” to continue.

By the way: If you want to make any changes, push on “zurück” to go back.

Step 4: How long should the life insurance be valid?

At this stage, you would also like to define for how long that insurance will have to be paid or should be valid:

“Wie lange soll Ihre Risikolebensversicherung bestehen?” How long do you want to keep your term life insurance?

Example:

Choose 23 years, assuming you have a 2-year-old daughter.

That way, you make sure that your family has enough budget to cover the expenses until she’s 25 in case you die.

Move ahead by clicking on “weiter”.

Step 5: Answer if you’ve been smoking in the last 5 years

Insurance companies consider you have a higher risk to die earlier if you’re a smoker.

At this step you should answer the question: “Have you been a smoker in the last 5 years?”

You have two options:

- Raucher (smoker)

- Nichtraucher (non-smoker)

Choose the variant that applies best for your situation.

Step 6: Enter your date of birth

In the next form field, Tarifcheck asks you for your date of birth (Geburtstag).

The reason is that your age is decisive for the calculation of the term life insurance.

Please enter it in the following format: DD/MM/YYYY.

Click on “weiter” to continue.

Step 7: Details about your current family situation

Familienstand (Marital status)

Here you can choose between 3 options:

- ledig (not married)

- verheiratet (married)

- geschieden (divorced)

Anzahl Kinder

Choose from following options:

- keine (no kids)

- 1 (kid)

- 2 (kids)

- 3,4,5,6

- mehr (more)

Berufsstatus 1

In the next field, you are asked to enter your profession.

This is to estimate your risk of dying early, especially when you have a physically demanding job.

Here you can select one of the options:

- Arbeiter/in (worker)

- Beamtin / Beamter (civil servant)

- Angestellte/r (salaried employee)

- Selbstständige/r (self-employed)

- Freiberufler/in (freelancer)

- Student/in (student)

Berufsstatus 2

The insurance company would also like to know if your work is:

- rather physical (überwiegend körperlich tätig)

- or rather desk job or commercial (überwiegend kaufmännisch tätig)

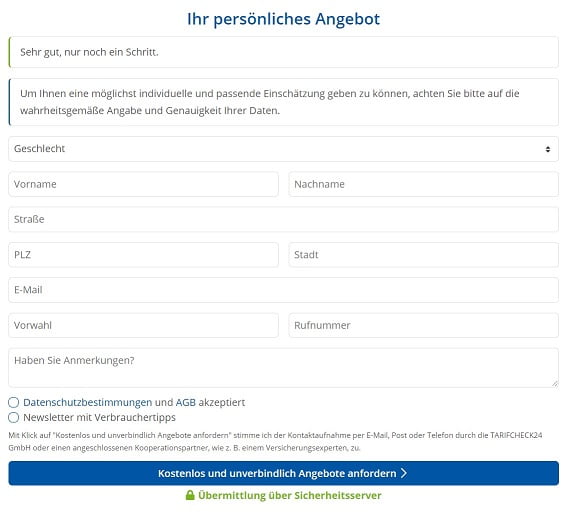

Step 8: Fill in details and get a quote for life insurance

This is the final step before you’ll get a quote.

Fill in following details:

Select gender (Geschlecht)

Check the radio button that says either sir, “Herr” or madam, “Frau”.

Your name (Vorname und Nachname)

Your first name and your family name.

Enter your address

Straße (street) + PLZ (zip code) + Stadt (city)

Email address

Don’t forget your email address.

Give them your telephone number

- Vorwahl (area code – of course, if it’s the case)

- Rufnummer (telephone number)

Tell them you would like to speak in English (or another language)

In the last field you can place your comments: Haben Sie Anmerkungen?

Tell them here you would like to be contacted by someone who speaks English. Or another language.

If they want you as customer, they will organize this, for sure.

Accepting the terms and conditions and asking for the quote

Check the first field (Datenschutzbestimmungen und AGB akzeptiert) after reading them (you can use an online translator). Eventually the second field, if you want to receive the newsletter from Tarifcheck.

And then push the blue button:

“Kostenlos und unverbindlich Angebote anfordern” = Request offers free of charge and without obligation

You will immediately get a confirmation email. In the next days you will be contacted by an insurance consultant.

Wrap-up

Even so, this process is quite long, it’s worth going through all those necessary steps because it is the easiest way to sign up for life insurance in Germany.

For me and my family, it provides peace of mind having such insurance with our favorite insurance company.

Now, in case of either my wife’s, my, or both of our deaths, our kids and the other partner won’t have to cover all upcoming costs within the next years.

And all our expenses are mostly covered.

USEFUL INFORMATION ABOUT GERMANY

___

INSURANCE IN GERMANY

> 15 types of insurance in Germany any expat should have

___

FINANCES IN GERMANY

> Find Best Rates for Loan in Germany

___

WAGES AND TAXES IN GERMANY

> Tax return Germany – Everything you need to know

> Average Salary in Germany Latest Data

___

WORKING IN GERMANY

> CV in German with Europass: How to fill in step by step

___

LEARNING GERMAN LANGUAGE

> How to learn German fast: Top 10 strategies

* The links marked in this way are affiliate links and indicate that we receive a small commission, if you decide to buy the products or services offered by our partner sites. There’s no additional cost for you. Powered by TARIFCHECK24 GmbH.