When you live and work in Germany, it is not that easy to calculate your net wage. In this post, I will shed some light on this so you can use the salary calculator for Germany with total confidence.

Below the salary calculator you will find the whole explanation plus a step by step guide, on how to fill in your data in the calculator.

Click HERE for Salary Calculator Germany

Deductions out of your gross income used in the salary calculator for Germany

In Germany, there are so many deductions from gross income that the amount left over in the end can be misleadingly high for newcomers. Why? The German tax and insurance system is quite confusing.

But you can understand it when you take some time to learn about it.

Topics in this article

Before you fill in the salary calculator Germany >>

Use of the salary calculator >>

Wage tax vs. income tax in Germany >>

Change of tax class in Germany? >>

How to change your tax category in Germany? >>

Social security contribution in Germany >>

Social insurance contribution in Germany >>

Tax free allowance in Germany >>

Good to know before you fill in the salary calculator Germany

The German tax system can be pretty complicated as the German tax system is progressive. It starts at 1% and rises incrementally to 45%. The rate of 42%, the so-called “Spitzensteuersatz” in Germany, applies to a taxable income above 57,052 € to 270,500 € for individuals.

Tax rates incorporated in the calculator that apply for couples

Couples may earn between 114,103 € up to 541,000 €. Unfortunately, there is no fixed tax rate in Germany that you can apply to your gross salary. This is the reason that makes the use of an income tax calculator so beneficial.

If you live abroad and are about to start salary negotiations with a German employer, using a salary calculator is a great help.

Especially if you know your fixed costs per month or the desired net salary you’d like to get.

But even if you are considering a move from one another country to Germany, you might be interested in your net salary because of the rather complicated tax system.

One example to explain the German salary calculator

I’d like to give you one example for tax calculation. I will assume a monthly gross salary of 3,500 Euros in the accounting year 2024, the tax class 3.

For this example, I assume that you also have to pay church tax, have no children and you have health, pension and unemployment insurance.

Example:

You are living in Berlin, the capital of Germany. Your tax calculation will look like this:

Gross salary: 3,500 Euros per month

Taxes you pay in total are 155.5 € and consist of:

- Solidarity Surcharge: 0.00 €

- Church Tax: 12.84 €

- Salary Tax: 142.66 €

All Social Charges add up to 736.75 € and consist of:

- Pension Insurance: 325.50 €

- Unemployment Insurance: 45.50 €

- Health Insurance: 285.25 €

- Care Insurance: 80.50 €

Your net salary lands at: 2,607.75 €

Comfortable salaries in Germany

One question that very often also comes up is:

What is a comfortable salary in Germany?

That mainly depends on your city of residence as well. Some cities have a high cost of living, like Munich and Hamburg. In the same time, Germany is not that expensive when renting an apartment or house in the countryside. Besides that, you can expect other living expenses like food to be very stable throughout the country.

In the following chapters, I explain the essentials to help you fill out the salary calculator for Germany.

German wage tax system

The above gross-net salary calculator 2024 for Germany uses the latest information and data from the German tax authorities (Finanzamt).

In this article, I try to summarize everything you need to know when calculating your net wage as a non-resident worker in Germany. In particular, I will focus on how much you have to pay in taxes and contributions when working in Germany.

How to use the salary calculator

To help you understand the salary calculator for Germany, I will give you a step-by-step tutorial on how to use the calculator from nettolohn.de.

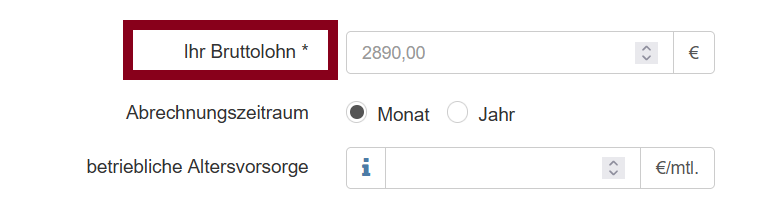

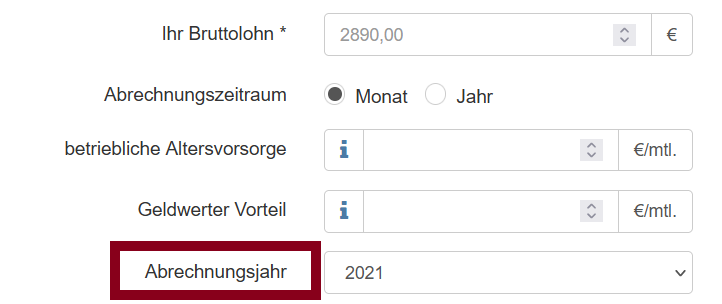

Step 1: Enter your monthly or yearly gross wage

First of all, you need to provide either your monthly or yearly gross wage – Ihr Bruttolohn. This is the salary you are negotiating with your employer because they will always pay the gross salary.

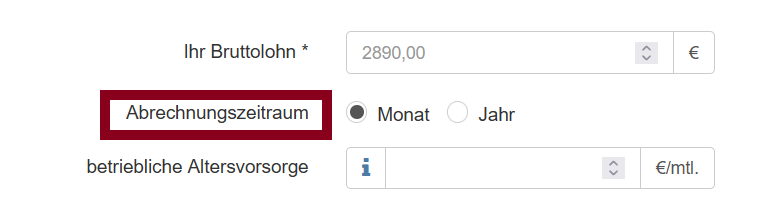

Step 2: Set the accounting period

The next step is to inform the income tax calculator about the accounting period- Abrechnungszeitraum. That information is essential to calculate your yearly and monthly tax expenses based on the salary you added in the line above.

Monat = Month

Jahr = Year

Step 3: Choose the accounting year

Setting the appropriate accounting period is essential, as tax years for employees always apply from January to December in one year. As you can imagine, there might be differences in taxes or insurance rates.

Abrechnungsjahr = Accounting year

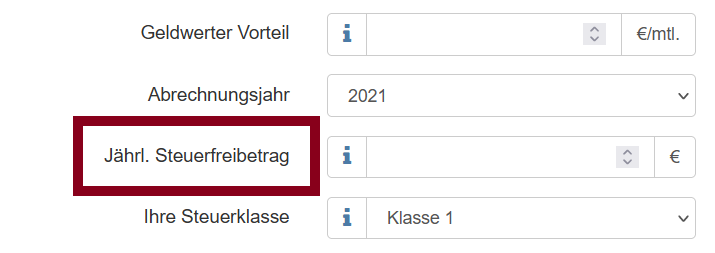

Step 4: Tax-free allowance

You should enter your tax-free allowance – Jährl. Steuerfreibetrag – into the online gross net wage calculator, depending on your marital status. For singles, the allowance in 2024 is 11,604 €, while for married couples or people living in a recognized civil partnership, the allowance is as high as 23,208 €.

Jährl. Steuerfreibetrag = yearly tax-free-allowance

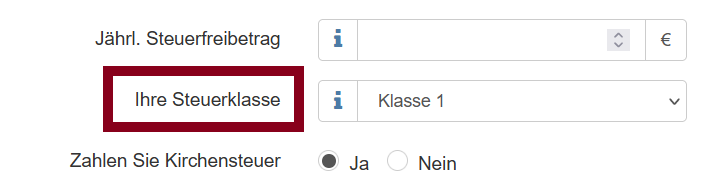

Step 5: Choose your appropriate tax category

Consider either looking at your payslip (if you already work in Germany) or at my overview of tax classes in Germany below. Choose the correct tax class depending on your specific life situation.

Ihre Steuerklasse = your tax category

Step 6: Add in the rest of the information

To use the German wage tax calculator properly, please add all applicable information in the form. In case you have difficulties with one or the other, please refer to this article.

Here is the translation of all the other fields:

Zahlen Sie Kirchensteuer? = Do you pay church tax in Germany? / Ja = yes / Nein = no

Ihr Bundesland = your province in Germany

Krankenversicherung = medical insurance / gesetzlich pflichtversichert = compulsorily insured / privat versichert = privately insured / freiwillig gesetzlich versichert = voluntary statutory insurance

Haben Sie Kinder? = Do you have children? / Ja = yes / Nein = no / Ihr Kinderfreibetrag = Your child tax allowance

Ihr Alter = your age

Rentenversicherung = Pension insurance

Arbeitslosenversicherung = Unemployment insurance

Wöchentliche Arbeitsstunden = Weekly hours worked

Anzahl Gehälter pro Jahr = Number of salaries per year

PLZ o. Ort Ihres Arbeitgebers = Postcode or city of your employer

Ihr Beruf = your occupation

Branche des Unternehmens = in which industry do you work

Geschlecht = gender

Berechnen = calculate your salary in Germany

Tax classes in Germany: In which tax category do you fit in for the tax calculator Germany?

In Germany, the tax class you are in depends on your marital status.

Which tax class you qualify for depends on your personal situation.

This helps employers apply the correct rates and deductions. This means they don’t make mistakes when applying taxes that could result in owing a lot at the end of the year. Or paying too little on their employees’ paychecks.

In addition, there are other components, such as the solidarity surcharge and church tax, deducted from employees’ gross salaries each time they receive a paycheck.

Tax Class 0

Tax category 0 only applies for people that are not German residents, so it’s solely for people living abroad but working in Germany.

This specific tax class is only valid for employees resident abroad whose wages are tax-exempt under double taxation treaties.

They use a particular term for those cross-border commuters. They are called “Grenzgänger”. In case no double taxation treaty applies, they use tax category 6.

Tax Class 1

Tax class 1 is intended for singles or taxpayers who are not or no longer married. Accordingly, this class is designed for persons who are single, unmarried (ledig), divorced (geschieden), or widowed (verwitwet).

Tax Class 2

Single parents have tax class 2. One of the requirements is that the single parent must live with at least one child. In tax class 2, there is a tax advantage due to the single parent relief amount, the “Alleinerziehendenentlastungsbetrag”.

Tax Class 3

Tax class 3 applies to married couples and is only possible for single earners or in combination with tax class 5. Generally, the higher earner should choose tax class 3. Tax class 3 is the tax class with the highest tax allowances and the lowest deductions. On the other hand, the deductions in tax class 5 are very high.

Tax Class 4

If you get married, you enter tax class 4 automatically. Tax class 4 applies to spouses who earn approximately the same amount, as the income tax is distributed fairly. Married couples can change their tax class to the tax class combination 3/5 or 4/4 with a factor.

Tax Class 5

You are eligible for tax class 5 only if your marital status is married. Class 5 only makes sense if your spouse earns at least 60% of the household income or you are not working at all. If both of you earn almost the same salary, it’s better to stick with tax class 4.

Tax Class 6

Tax class 6 is intended for employees who have two or more jobs. The second job (if it exceeds the mini-job limit of 520€) is always taxed according to income tax class 6. In tax class 6, the deductions are exceptionally high.

What is the difference between wage tax and income tax in Germany?

To help you understand the difference between wage and income tax in Germany, it’s essential to know about both terms’ definitions.

The difference between “wage” and “income,” while not always clear-cut or absolute, relates primarily to how they’re received.

Wage payments occur at regular intervals like monthly payrolls, whereas income includes any other form that may come your way.

These could be bonuses from work overtime, payouts on dividends paid out by stocks you own, or even gifts!

The federal tax ministry “Bundesfinanzministerium” explains that the income tax is paid for everything you earned throughout one tax year while the wage tax is paid monthly partly by you and your employer.

To give you an example:

Imagine you have a monthly gross salary of 4,000 € and occasionally rent out an Airbnb apartment for about 1,000 € per month. In that situation, you will have to pay a separate income tax on those additional 1,000 € either on a monthly, quarterly or yearly basis, depending on your negotiations with the local tax office.

Can I change my tax class in Germany?

In general, as I will explain below, you can change your tax class, for example, from 4 to 3 or 5 if you are married to someone. This change is a voluntary decision to be made by you. All other tax changes happen “automatically” depending on your marital status, residency, or occupational status.

How to change your tax category in Germany?

Compared to tax calculation and tax returns, the process to change your tax class in Germany is relatively simple.

Changing your tax category only applies to married couples, and it is only recommended if the higher-earner earns around 60% or more of the total household income.

- First, I recommend you to get a hold of the form “Antrag auf Steuerklassenwechsel bei Ehegatten” (request for change of tax class for married people). You can either fill it online here on the website of the finance ministry and download it afterwards as a PDF file. If you prefer to fill in the form on your computer, you can consider downloading the empty PDF file here.

- As this document requires your and your partners signature, you will have to print and sign it.

- In a third step, please send it to your local tax authority (Finanzamt) either by post or drop it into their mailboxes.

What you should keep in mind

The tax class change will happen in the month following your submitted request. So that’s when you can see a difference in your net salary!

This change is possible only once a year except if one of the reasons for a tax change applies to your situation:

- Your hiring status of you or your partner changes and you are no longer an employee.

- If you or your partner is hired again as an employee

- You or your partner pass away

- If you are getting divorced or separated from each other

Will you have to pay the church tax in Germany?

The amount of your church tax (worship tax) depends on the income you receive. In addition to your salary, it is also due for severance payments and capital gains. The laws are regulated by federal states in which they live in Bavaria and Baden-Württemberg taxes collected at 8%, all other federal states 9%.

A few congregations gather themselves with money taken from their members. If liable to pay taxes due to their religious community, this will be indicated on their electronic card from the government that tracks them using an employer pays directly into earnings office.

Is there any social security contribution in Germany in the salary calculator for Germany?

If you are employed in Germany, the German government requires that you make compulsory social security contributions.

The contribution burden is split evenly between employer and employee – meaning your average total monthly payment is around 20-22%.

Your charges will be deducted directly by your employer from each of your paychecks.

How much is the social insurance contribution in Germany?

The following social security contributions are levied on employment income in 2024:

Employer contributions are generally tax-free.

The pension insurance is at 18.6%.

Unemployment insurance is at 2.6%

Health insurance is at 16.3%

Long-term care insurance is at 4 %

All of these insurances are split in half between employer and employee.

Health insurance in Germany

Almost everyone must contribute to statutory health insurance (currently, around 90% of the population is covered by a GKV scheme).

Your contribution is split equally between your employer and yourself up to what’s called “Gesetzliche Krankenversicherung”, which covers most medical costs, including hospital treatments, dental care, medicines, etc.

To qualify automatically for sickness benefit (Krankengeld) and maternity benefits – Mutterschaftsgeld you have to contribute to the statutory health insurance.

Read here more: Best German Health Insurance

Additional health insurance

If you are self-employed or earn more than 69.300 euros per year, you can choose to take out private health insurance.

Additional health insurance options would go off your net income, like premium dental care, premium hospital insurance, and others.

Long-term care insurance

Germans are required to pay into a socialized long-term care insurance system. This ensures that they receive quality healthcare benefits in their old age, should accidents or illness occur. You are automatically enrolled as long as you pay for the statutory health coverage.

Long-term care insurance amounts to a maximum of €4,837.50 per month in both east and west Germany and is paid half by you and half by your employer.

Read here more about Private care insurance in Germany

Pension contributions

Pension insurance is mandatory for everybody who earns a wage or salary in Germany. This specific insurance covers any/all illnesses and injuries that might occur during work (including home-office).

Some employers will pay for this insurance themselves. Others expect their employees to contribute between 2% and 5%.

If you have an employer who pays for half of the insurance, you only have to contribute 1% yourself.

Unemployment insurance

If your employer – for whatever reason – no longer pays you your full salary, be prepared to apply yourself.

As a rule, you will receive remuneration replacement benefits or wage replacement benefits, but it is tax-free and subject only to the progression proviso (tax code).

While these wages are not taxed at 100%, they contribute in some way towards calculating how much other income might be taxed on top of that with higher percentages.

For that reason, it’s required that you declare all wage replacement benefits in your tax return.

How high is the tax-free allowance in Germany?

If you’re single and not in a civil partnership, by 2024, the basic tax allowance will be 11,604 €. If you are married or in a civil partnership, this threshold rises to 23,208 €.

Alternative salary calculator tool

Recently, I have used also an alternative tool for calculating the net salary in Germany. This is created especially for expats and it is in English.

Check it out on Arbeitnow.

Conclusion

I hope this information has been helpful for you and that it helped answer some of your questions about the German tax system.

To help you calculate your net salary, I put together all information provided above as the German tax system can be pretty challenging to understand if you did not grow up in this country.

You may find my salary calculator useful- just plug in your income and see what percentage goes to taxes on average. Happy calculating!

Also interesting in this context: